The ASX200 rallied solidly on Wednesday embracing what was surprisingly benign inflation data which suggests the RBA will be able to hold off longer than expected before it pulls the trigger on rate hikes. The quarter on quarter CPI print of 0.6% was significantly below economists’ forecasts of 0.9% immediately lessening market fears of rising rates in 2021, even as Retail Sales came in higher than expected. The almost goldilocks macro-economic backdrop for stocks of ultra-low interest rates while economic growth accelerates aided by governments / central banks stimulating their economies post COVID remains firmly in play.

Interestingly the “Big 4” banks outperformed even though they are supposed to prefer a rising yield environment, at least from a margins perspective. The flipside of course is that banks are heavily leveraged to the ebbs and flows of the economy and yesterdays read was a positive one in this regard. It’s worth remembering that while the macro backdrop is influential, ultimately, it’s the outlook for earnings that is the key driver of stock prices and a period of strong economic growth is good for bank earnings.

However, it was the Real Estate Sector which carried the torch advancing 1.5% as the fear of rising rates faded into the distance – all 21 names in the sector gained demonstrating the enthusiasm after the CPI data – more on this later. The Resources / Materials Sector was the only group to slip as profit taking appeared the “rigueur de jour” even as the likes of copper and iron ore rallied – BHP recovering +0.8% in the US as oil rallied should address some of this move this morning.

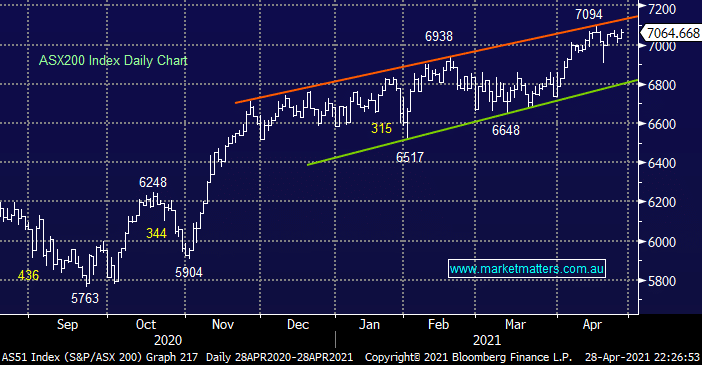

The local index remains less than 1% below its 2021 high and we feel another push to 7100 is inevitable into May but we still aren’t keen buyers of risk around current levels i.e. it’s hard to see the favourable tailwinds becoming any stronger short-term.

Overseas stocks closed mixed with the US S&P500 basically unchanged while tech fell -0.4%, however the SPI is calling the ASX200 to rise almost 20-points following a strong session in Europe.