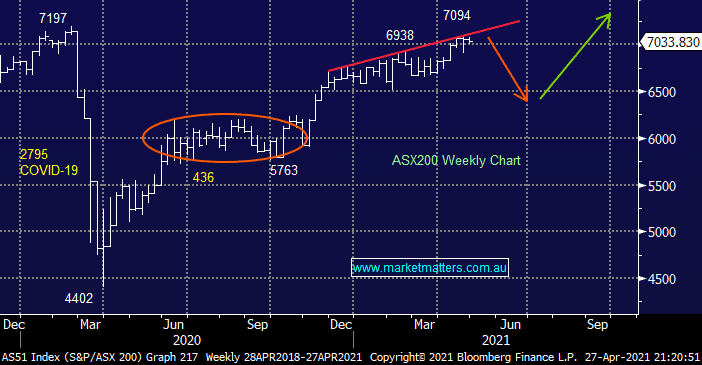

The ASX200 continues to oscillate around the psychological 7000 level ignoring both good and bad news over recent sessions. Yesterday we saw further positive M&A news from both Bingo (BIN) & Tabcorp (TAH) plus an iron ore sector continuing to recover strongly but disappointingly with over half of the ASX falling the underlying index was unable to register a gain for the day – the stock / sector rotation continues.

The “buy the dip” optimistic attitude was noticeably on display in Japan yesterday after Nomura closed higher even after the bank took a $US2.9bn hit courtesy of trading house Archegos’ huge losses. Similarly India’s BSE Sensex Index has only slipped 7% from its March high even as the country continues to implode under the weight of surging COVID numbers, an especially remarkable result considering the index has more than doubled over the previous 12-months – investors are clearly scarred to sell stocks as they adopt a “she’ll be right in the end” attitude to the whole coronavirus issue.

After US stocks closed yesterday Tesla (TSLA US) delivered an underwhelming result, when compared to expectations, resulting in the innovative EV car makers shares slipping ~4.5%, an ok result considering its appreciation over the last year. As the week sits poised to deliver some meaningful news on both the stock and macro level markets appear to be bracing for such updates before reacting accordingly.

Overseas equities closed mixed with the DOW / S&P500 unchanged while the NASDAQ slipped almost 0.5%. The SPI futures are calling the ASX to open marginally higher in-line with a strong performance from the US Financial Sector.