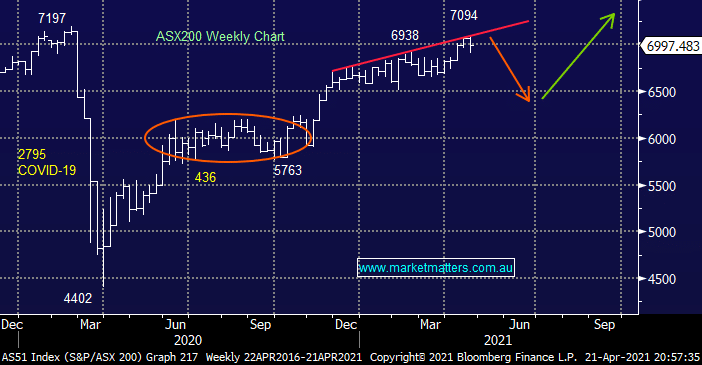

The ASX200 only closed down -0.3% yesterday after recovering well over 80% of the losses registered at lunchtime – it picked the US market well again. We touched on the almost decade old “buy the dip” mentality in Wednesdays report and its was again very much in evidence as bargain hunters emerged into Wednesdays afternoon trade. MM’s looking for a pullback towards 6500 in the coming months but we believe its likely to be a begrudging correction similar to the one experienced between June & September 2020, such a move would coincide with the “smart money” slowly accumulating into weakness – we ultimately think this bull market has further to run.

The reason we believe any such pullback is likely to lack acceleration is simply down to stock / sector rotation, as we saw yesterday investors might be migrating away from some of 2021’s top performers but rather than flock to cash we’re seeing interest pick up in the likes of Healthcare & Gold i.e. two of the classic defensive sectors. MM is looking for further rotation out of sectors such as Banks and Resources into the classic yield plays – we’ve even considered Telstra (TLS) for our Flagship Growth Portfolio in addition to our existing holding in the Income Portfolio.

For those that missed it our quick 5-minute video yesterday afternoon discussed some of our these thoughts and our current mindsight over the ensuing few months – Click here to watch

Overseas stocks bounced nicely to recover basically Tuesdays losses with gains pretty even across the board as the reopening theme was embraced, locally the SPI futures are calling the ASX200 up ~0.5% helped by BHP rallying almost 50c in the US following their quarterly update.