WiseTech’s moat has historically been built on complex, deeply integrated logistics software that took years to develop. But AI is now slashing development costs and accelerating feature delivery, giving newer AI-native competitors a faster path to parity in automation, routing, document processing and optimisation. That’s led investors to question whether WiseTech’s technology edge is still as defensible, driving valuation compression. The fear isn’t an immediate loss of leadership, but gradual share leakage at the margins, starting in specific modules, alongside weaker pricing power and a shorter growth runway.

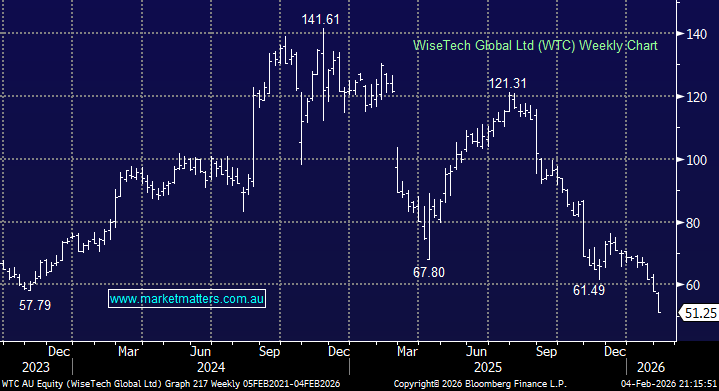

At the same time, global capital has rotated toward AI “pure plays” in compute, cloud and data platforms. Despite its own AI initiatives, WiseTech hasn’t been viewed as a core beneficiary, weighing on sentiment and multiples. Like Xero, it was priced for premium growth, but that premium is being repriced as AI commoditises parts of the logistics stack. Even at ~39x FY26 earnings, the stock is still more than 40% below its five-year average. WiseTech has also leaned on acquisitions. In mid-2025, it paid US$2.1bn for e2open’s Strategic Logistics business, a deal that looks expensive today, even if it materially expands CargoWise’s footprint and adds broader supply-chain capabilities across planning, trade, logistics and multi-enterprise networks.

With revenue forecast to increase to $1.6bn in FY27 from less than $800mn in FY25, growth is still unfolding, but Richard White and his team will need to keep delivering to see the stock challenge its 2024/5 highs. We believe WTC’s growth engine remains global penetration + upsell, with AI acting as the turbocharger, crucial for defending the moat and improving the product, but not the sole growth driver. In the cold light of day, assuming they integrate their recent $US2.1bn acquisition successfully into the business the valuation doesn’t feel too onerous unless freight forwarders, customs brokers, carriers and shippers manage, automate and optimise global supply-chain operations start to consider displacing WTC = clear big risks.

- We believe WTC is a world-class company, but valuations in this space could continue to contract as uncertainty persists.