WTC’s moat has historically been built on complex, deeply integrated logistics software that took years to develop. With AI dramatically reducing development costs and accelerating feature delivery, newer competitors, especially AI-native platforms, are perceived as having a faster path to parity in areas like automation, intelligent routing, document processing and optimisation. Hence, Investors are questioning whether WTC’s traditional technology lead remains as defensible as it once was, leading to valuation compression. If those AI-native products start to win customers at the margins – or take share in specific modules – investors worry CargoWise could face gradual market-share leakage over time, alongside weaker pricing power and a slower growth runway, even if it remains the category leader.

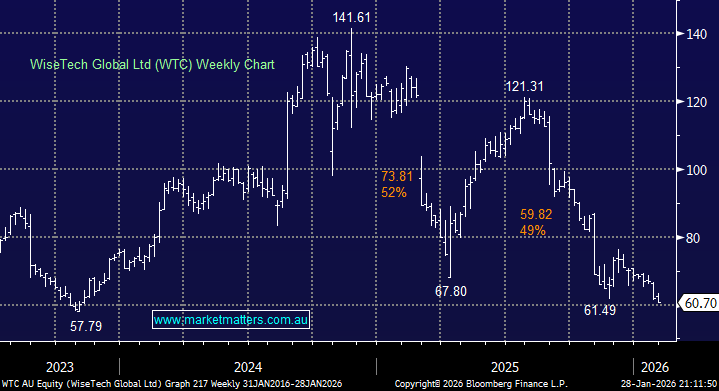

Global investors have rotated capital toward AI-centric stocks, often preferring scalers of generative AI compute and data platforms over “traditional tech” names with slower AI narratives. WiseTech, despite having AI initiatives, has not been viewed as a core beneficiary of the AI boom in the same way as pure AI or cloud leaders. That has weighed on sentiment and relative multiples. Similar to XRO, WiseTech was/is commanding a growth valuation, in its case around 58x FY26 Est earnings, which is over 40% below its average 5-year valuation, and still falling. Historically, much of WTC’s valuation was priced on premium growth expectations, but as AI threatens to commoditise elements of its value proposition, and as competitors layer AI into logistics technology stacks, forecasts for sustainable long-term growth have been repriced lower.

Over the years, WTC has been an active acquirer, and AI should now make this cheaper or even unnecessary as it searches for growth and margin improvements. i.e. it was historically cheaper to buy than build in some cases, but that may have now flipped. Similar to Xero, in mid-2025, WTC purchased e2open’s “Strategic Logistics” business (including the Shippeo/INTTRA-linked logistics software assets) for $US2.1bn, another purchase that looks very expensive in the current environment. However, the strategic acquisition significantly expands WTC’s global supply chain software footprint and customer base, adding extensive cloud capabilities across planning, trade, logistics and multi-enterprise networks to its CargoWise platform.

With revenue forecast to increase to $1.6bn by FY27 from less than $800mn in FY25, growth is still unfolding, but Richard White and his team will need to keep delivering to see the stock challenge its 2024/5 highs. We believe WTC’s growth engine remains global penetration + upsell, with AI acting as the turbocharger, crucial for defending the moat and improving the product, but not the sole growth driver.

- CargoWise still has a long runway as the global standard for tier-1 freight forwarders. More wins and rollouts across regions remain the biggest driver.

- WiseTech keeps adding modules (customs, warehousing, compliance, landside, finance, etc.). The more workflows it owns, the stickier the platform and the higher revenue per customer.

- As more carriers, customs systems and third-party apps plug in, CargoWise becomes harder to displace, supporting pricing power and retention.

WTC’s moat remains solid thanks to integration depth and switching costs, but AI makes it easier for challengers to attack around the edges, meaning the moat is strong, but no longer unquestioned, hence the share price.

- We believe WTC is a world-class company where valuation is becoming increasingly attractive