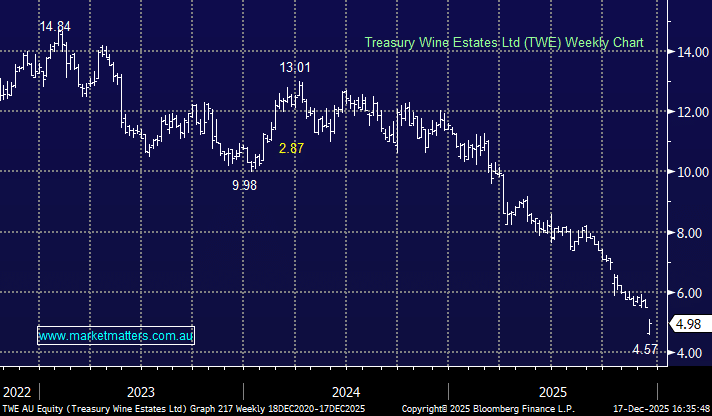

TWE shares hit their lowest level in more than a decade, falling as much as 17%, after the company unveiled a broad reset under new CEO Sam Fischer, just six weeks into the role.

- $100m p.a. cost-out target, to be delivered over 2–3 years

- $200m buyback cancelled and capital expenditure under review

- Asset sales flagged as part of a wider portfolio rationalisation

They lowered guidance for 1H26, saying EBITs will be in the range of $225m to $235m, and while they said the 2H will be higher than the first, it was still a ~30% miss v consensus.

Management acknowledged category weakness in both the US and China, TWE’s two key growth markets, which will weigh on near-term earnings. In China, a crackdown on government banquets is hitting demand, with TWE planning to cut distribution volumes by ~0.4m cases over two years. US conditions remain difficult, compounded by disruption following the collapse of a key California distributor.

While the cost-out is meaningful, it’s hard to see a clear path to sustainable top-line growth in China and the Americas. Ultra-luxury wine is also underperforming expectations, with US luxury sales now declining.

Clearly, the strategic reset was necessary, but the downgrade underscores how tough the operating backdrop has become. Cost cuts can stabilise margins, but until demand conditions improve or a credible growth narrative emerges, confidence is likely to remain fragile.