- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

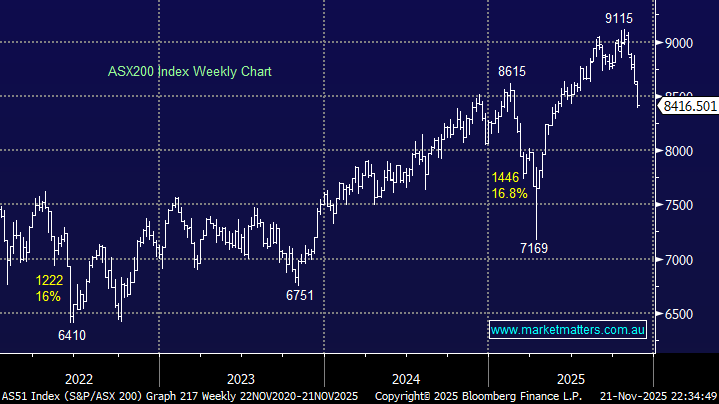

The ASX limped into the weekend, chalking up its fourth straight weekly loss. That’s a tough run by any measure, putting November’s losses at ~5% so far — the worst monthly showing since September 2022. Ongoing uncertainty around US interest rates after a slightly stronger-than-expected US labour report showed 119k jobs added vs. 50k expected, while risk off flows have knocked the likes of Bitcoin, now trading $US86k down from $US125k high.

- The ASX200 fell -136/-1.59% to close at 8416.

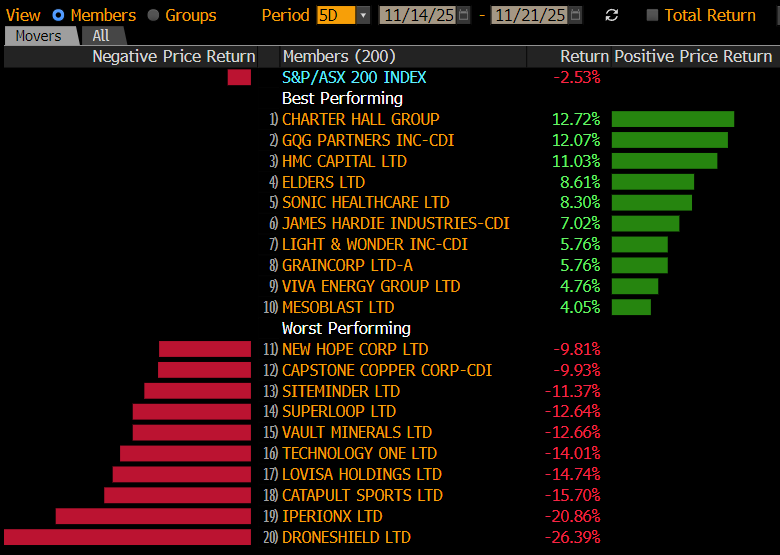

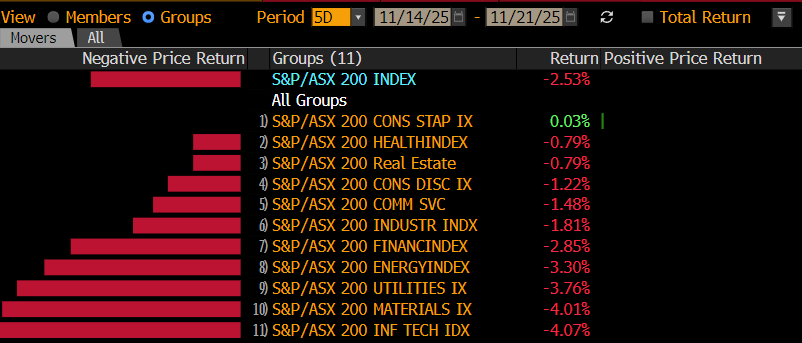

- Consumer Staples (+0.04%) and Healthcare (flat) the only semblance of stability.

- Materials (-3.93%), Energy (-3.11%) and Property (-1.97%) the weakest links.

- WiseTech ([WTC) +2.4% bucked the negative trend today after the logistics software group reaffirmed its FY26 guidance at their AGM

- Lovisa (LOV) -13.8% fell as same-store sales slowed after a strong start. High expectations + softer momentum = sharp sell-off.

- Accent Group (AX1) –15.4% provided another tough update as the company cut FY26 earnings outlook. Heavy discounting and weak early-year trading are clearly biting.

- Autosports Group (ASG) –2.2% said they are acquiring 10 Barry Bourke Motors dealerships for $34m — expanding footprint and premium brand relationships.

- Kogan (KGN) +0.6% saw EBITDA of $10.1m for the first four months of FY26, but down 31% YTD due to NZ weakness.

- Reece (REH) +2.1% saw EBIT down 18% in the September quarter, but investors seemed prepared for softness.

- Webjet (WJL) +1.7% was higher after BGH Capital lifted its buyout offer to 91c per share, slightly above Helloworld’s 90c bid earlier in the week.

- BHP -3.2% was soft as negotiations drag on between China’s state-run buyer who asked mills to halt purchases of Jingbao fines, BHP’s low-grade ore.

- Oil eased as news broke that Ukraine will work on a US-Russia drafted peace plan. That, combined with looming US sanctions on Rosneft and Lukoil, has created a messy and confused supply outlook.

- Gold names were hit hard as rate-cut hopes faded – Newmont (NEM) –6.1%, Northern Star (NST) –4% & Evolution –4.5% all whacked.

- Gold traded down during the session to $4050/oz around the close.

- Iron Ore in Singapore traded up +0.3%, now trading $104.2/mt at our close.

- US futures are up +0.5%.