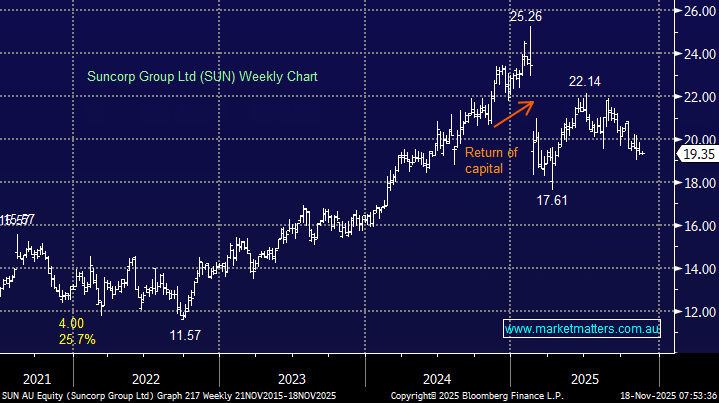

SUN is now a very different business, having sold its banking arm to ANZ and emerging as a pure-play insurer able to focus squarely on its core operations. The stock is currently trading ~13% below its post–capital return high following the sale. Looking ahead, the FY26 outlook appears solid. In August, the Queensland-based insurer guided to mid-single-digit gross written premium (GWP) growth, underpinned by the ongoing earn-through of prior premium increases and improving reinsurance market conditions. Like QBE, this is another business that should benefit from a less aggressive path of rate cuts by central banks.

- Within the insurers, SUN is our preferred insurer for yield, forecast to pay 5.3% fully franked over the coming 12 months, while QBE is coming from a lower base and has greater growth appeal.