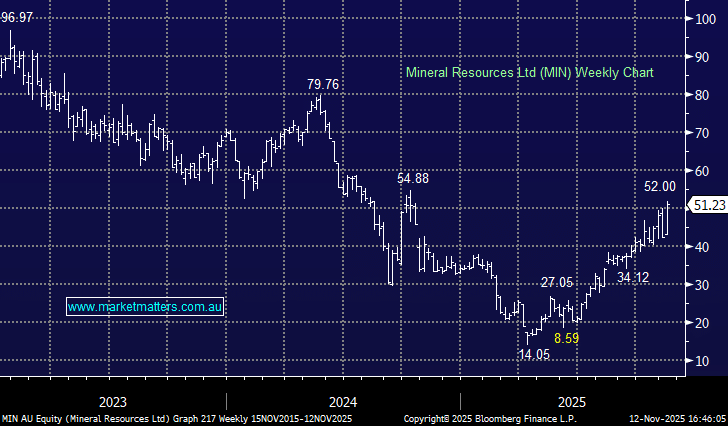

We’ve gone off-piste for our last stock, though we’re using it to highlight an important theme. Yesterday, we saw South Korean POSCO pay Mineral Resources $1.2bn for 30% of its operational lithium business. Importantly, this values MIN’s existing 50% interest in Wodinga and Mt Marion Lithium mines at $3.9bn – well north of what many in the market had their value pegged at (MM included).

While lithium (and the lithium miners) have been under intense pressure in recent years, we believe the tide has turned, and lithium supply is now becoming more highly valued – a theme demonstrated yesterday through MIN. As we highlight in this note, this is a long term structural thematic, and while Lithium has already experienced a boom-and-bust cycle, typical in commodities, we are now seeing early signs of the next boom.

- We believe the deal between POSCO and MIN announced yesterday, demonstrates strategic buyers are placing more value on long term Lithium supply than the market currently is, which is bullish for the Lithium producers.