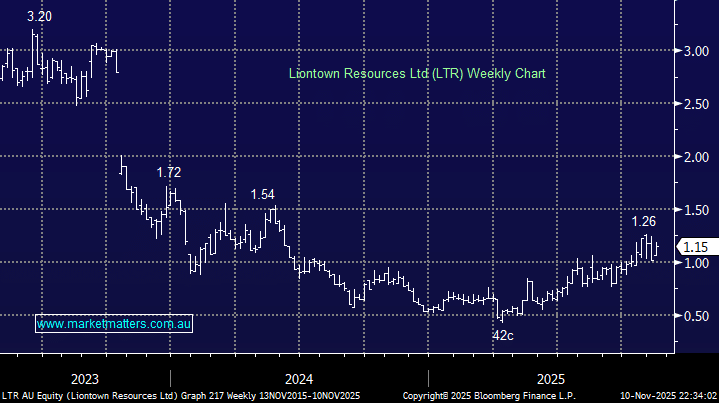

LTR was the top performing stock on the ASX200 on Monday, surging +12.8% as the lithium names surged higher. LTR raised $266mn at 73c in August, giving the company around 18-months of breathing space for lithium to average ~$US1,100 in 2026, and $US1,000 in 2027, where it will achieve free cash flow (FCF) breakeven – not far now!

- We can see LTR testing its $1.50 resistance area into 2026 – MM owns LTR in its Emerging Companies Portfolio.