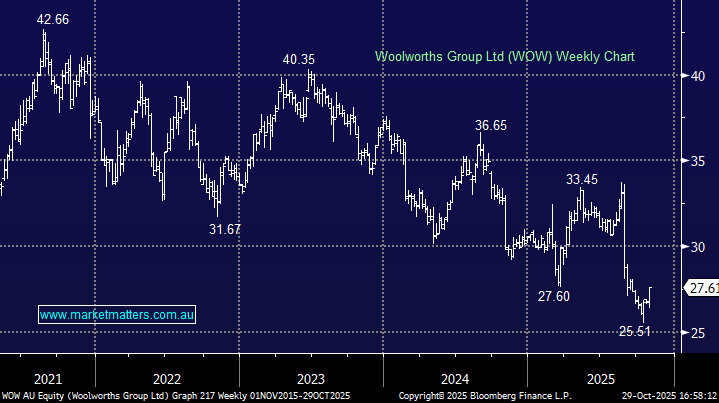

Not a classic rate-sensitive stock per se but it caught our attention yesterday. WOW has been a major underperformer in recent years, especially compared to rival Coles. So far in 2025 WOW is down -9.5% while COL is up +20.2%. Yesterday, the company reported an ok 1Q, which met analysts’ estimates. For example, food sales of $13.89bn, up +2.1% YoY, were just below Bloomberg $13.93bn estimate. CEO Amanda Bardwell is facing intense pressure to win the key Christmas period after the retailer’s recent price cuts failed to resonate with shoppers, resulting in lacklustre sales growth in the first three months of the new financial year, but the advance in the share price yesterday illustrates that expectations are very low for this household name.

It was encouraging to hear the head of the nation’s largest grocery chain said she was “cautiously optimistic” about the holiday period, with supermarket sales in the second quarter so far up 3.2%. Woolworths has launched more than 650 new Christmas products, calling the festive season “critical to win”. With the market clearly “all-in” on COL over WOW, for good reason, we see some reversion percolating beneath the surface.

- We think the risk/reward dial has turned for WOW, especially as defensive stocks could gain traction into 2026 as the interest rate tailwind dissipates.