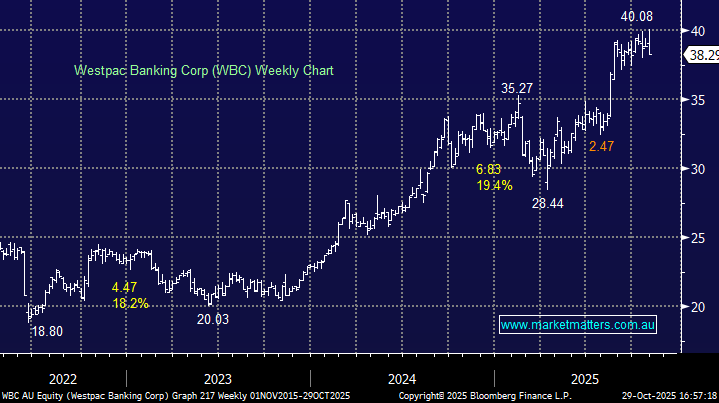

WBC tumbled over 3% on Wednesday as the hot CPI weighed on the banking sector. WBC, along with ANZ and NAB, will report in the coming days and after their stellar run to fresh highs, it’s no surprise that investors took some profit ahead of their respective reports. Overall, the rally in the banks feels mature, but while we don’t see reason to sell aggressively at this stage, they do look to be entering a “sell the strength, and buy the weakness” period of consolidation – WBC is forecast to pay an 81c fully franked dividend next month.

- We can see WBC drifting back towards $37.50, but its looming dividend should see appetite return in November: MM holds WBC in our Active Growth Portfolio.