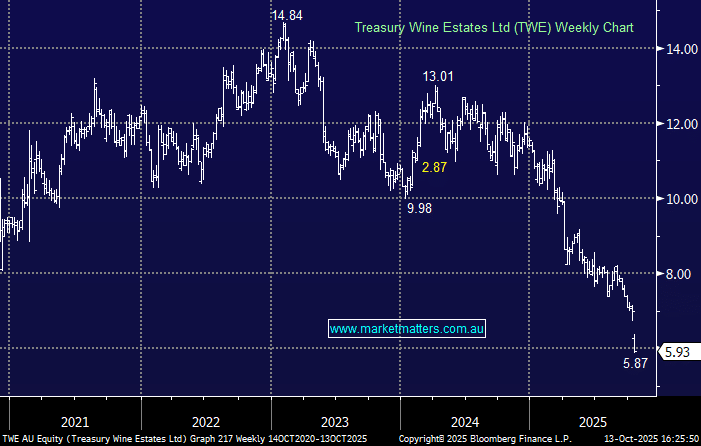

TWE -15.04%: Had its sharpest fall since 2020, after withdrawing FY26 earnings guidance and pausing its share buyback. The decision comes amid soft depletions, shifting consumption trends among the younger demographic, and uncertainty across China and the US as the incoming CEO prepares to reset strategy.

Weakness in the Americas and ongoing distributor disruptions were already well flagged, however the full withdrawal of Penfolds for both FY26 and FY27 guidance came as more of a surprise to the market and shows the unpredictability of Chinese demand.

When we last discussed TWE around $8, we highlighted the downgrade cycle and fragile sentiment toward the business and China-facing stocks in general – those risks have now come to pass. At ~$6, the stock is pricing in plenty of pessimism and valuation looks tempting, though the lack of guidance, uncertainty in China, and management transition leave few near-term catalysts to spark a reversal in appetite for the stock.