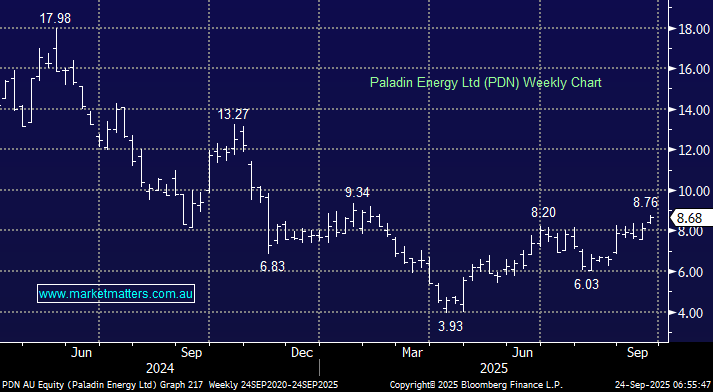

Last week, Paladin tapped the market with a A$300m underwritten equity raise (plus a A$20m SPP) at A$7.25/sh, representing an ~8% discount to the 5-day VWAP ahead of the announcement. The share price has performed well since, with the available SPP now priced at a ~20% discount to last, making it very attractive for investors to try and pick additional shares, up to 30k.

- The raise was split across an ASX placement, a Canadian bought deal, and a block sale of shares from the Fission acquisition, On UBS numbers, the issue is around 11% dilutive.

The funds will mainly be put towards the Patterson Lake South (PLS) project they picked up through the acquisition of Fission in Canada – it is one of the world’s most significant undeveloped uranium deposits, with $170m allocated there, alongside $100m of working capital and exploration, with the remainder spread across FY26 exploration and other costs. Importantly, this spend is more about de-risking the $1.25b project capex task ahead rather than accelerating metrics, which remain unchanged. We were a little surprised by the timing – raising before further derisking at Langer Heinrich – but it does strengthen the balance sheet and the Uranium market has materially improved in recent months.

Paladin also provided an update on their Langer Heinrich Mine (LHM) in Namibia. Production for the August quarter came in at ~727klb, putting FY26 volumes on track toward the upper-end of 4.0–4.4Mlb guidance. Grades remain difficult to assess, given that stockpile feed is still dominant, but operational metrics are broadly in line. Sales were lighter at 533klb, tracking a touch below 3.8–4.2Mlb guidance, but nothing alarming at this stage.

The backdrop in the Uranium market remains supportive. While supply uncertainty lingers – Paladin itself among those with revised timelines – the demand outlook continues to strengthen, with governments worldwide reaffirming nuclear’s role in energy transition and big tech signaling interest in nuclear-linked projects.

- Against this backdrop, we continue to believe that Paladin’s positioning with high-quality assets at both LHM and PLS remains attractive, though the equity raise highlights the scale of capital intensity still ahead.

Paladin has chosen to bolster its war chest early, de-risking the next leg of PLS development. While the raise is dilutive and a touch ahead of schedule in our view, the positive uranium thematic remains in its favour. Execution at LHM and capital discipline at PLS will be key catalysts from here.