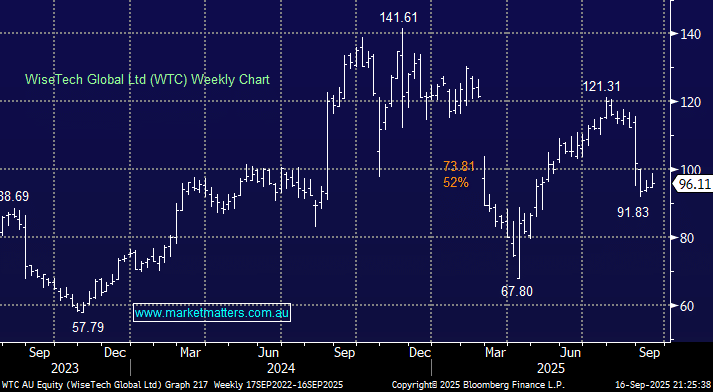

WTC’s shares have been under pressure through 2025, with the stock currently down 4.9% year-to-date, not the significant outperformance investors have become accustomed to over the years. There have been three main reasons the stock has struggled, although we note, falling less than 5% isn’t too bad considering the headwinds it’s faced:

- In February, the stock plunged ~30% after four board members resigned amid governance turmoil and allegations against founder Richard White; this was compounded by weaker revenue guidance.

- In May, WTC bought e2open Parent Holdings for ~$US2.1bn, its largest ever acquisition, raising questions around value and risks of integration into its core business.

- In August, the stock dropped over 10% after FY25 revenue missed expectations and FY26 guidance flagged margin pressure from its e2open acquisition.

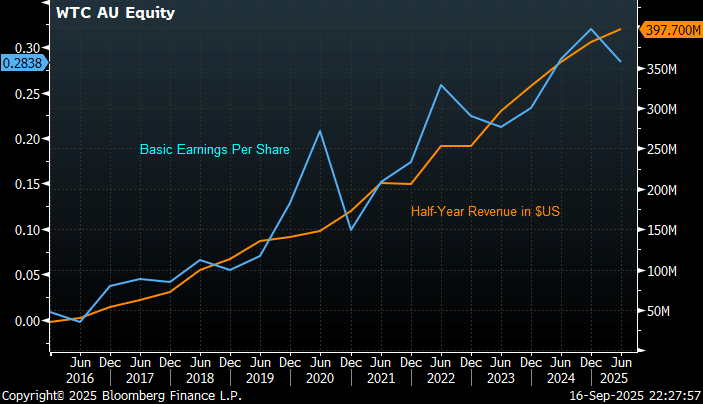

The short-term risks for this $32bn logistics software company have increased, but as the chart below illustrates over the last decade, such pullbacks have been opportunities for investors as the company’s revenue pushed ever higher. WTC’s financials are extremely impressive:

- WTC enjoys 97% recurring revenue with less than 1% churn rate for the last 12 years.

- The company generates ~$1bn in annual revenue, dropping down to 32% free cash flow.

- The stock is up well over 20x since its IPO in 2016 with annual revenue growth of +25% pa.

- It enjoys 50% EBITDA margins, with strong pricing power, and its business, CargoWise, is passing on 6-10% annual price rises.

Basically, the only thing hard to stomach about WTC is its valuation, which is still 78x for FY26, but this could easily be justified if the e2open deal starts to deliver and it achieves its FY26 $US1.4bn revenue target, an 80% lift on FY25. It may be a big deal, but WTC has history on its side, having bought 53 businesses since its IPO, with these acquisitions contributing ~30% of its average annual revenue growth. We believe this very same M&A activity has stifled businesses that could have become more meaningful competitors.

The company has spent ~$1.1bn in R&D over the last 5-years with over 60% of its employees working directly to improve the product. With Richard White passionate around AI its likely to cost billions to challenge its domination, remembering that once WTC’s software is implemented, it’s hard and expensive to rip out. So we know WTC is a great business today, the question is what comes next:

- Revenue growth over the coming year should be impressive from acquisitions, and given the long integration period for revenue after new customers sign, usually a few years.

We see two material risks moving forward. Firstly, WTC’s founder and driving force Richard White, is 70 years old, not a spring chicken, although his current passion for the business only seems to be growing as he looks to move on from his personal and company governance issues. Secondly, the same AI that WTC are focusing on today could help a rival deliver a cheaper product, but as we said, this won’t come cheap in the current AI landscape – attempted in-house solutions have cost companies fortunes over the years, with DHL and Nippon Express both wasting over $100mn, with the former rumoured to have wasted closer to 10x that amount!

- We continue to believe WTC is a world-class business, and we will consider averaging our position around the $90 area.