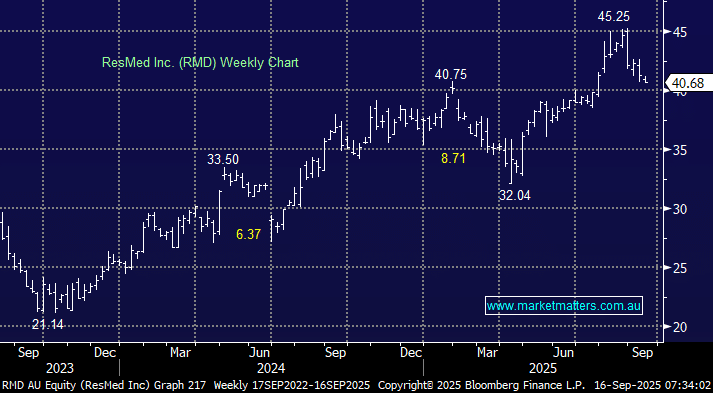

RMD has drifted 10% in recent weeks, taking its direction from a lacklustre healthcare sector. The stock rallied into and through its fourth quarter FY25 earnings on July 31st but its struggled since, taking little solace from a strong market. The CEO and CFO have sold modest amounts of stock in recent weeks, but nothing to concern us at this stage and the weakness feels more attributable to profit taking, especially as many of its peers have struggled of late, e.g. switching a portion of an RMD holding into CSL would make sense to some.

- We like the risk/reward towards RMD around $40.