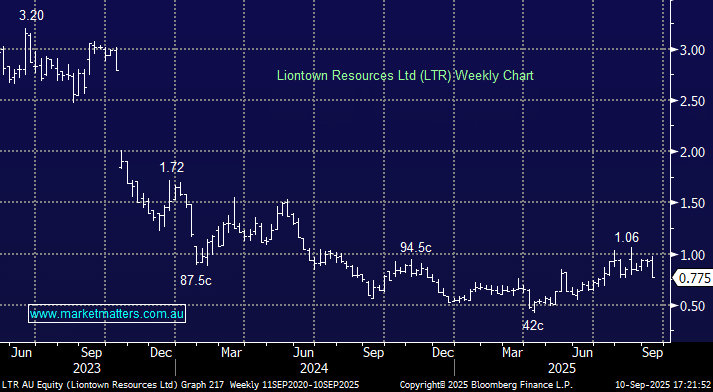

LTR was the worst-performing ASX200 stock on Wednesday, plunging over 18% as the hot money exited. This high-cost producer needs lithium to extend its recent advance, not fall as it did yesterday, to turn the dial from a profitability perspective. The miner’s recent capital raise at 73c has strengthened the company’s balance sheet, and with the Albanese government investing $50 million as part of the capital raise, it feels that support is likely into further weakness below 80c.

- We can see LTR breaking above its recent $1.06 high in the next year, but its journey is likely to be volatile. We own LTR in the Emerging Companies Portfolio.