NCK has been a terrific performer over the years, rewarding investors who backed management’s ability to grow the business both domestically and, more recently, offshore. We were particularly supportive of their prudent foray into the UK via Fabb Furniture – a relatively small outlay that provided exposure to a huge £24bn market. The approach was measured and reminded us of Carsales (CAR), which built a strong offshore presence by starting small and scaling carefully.

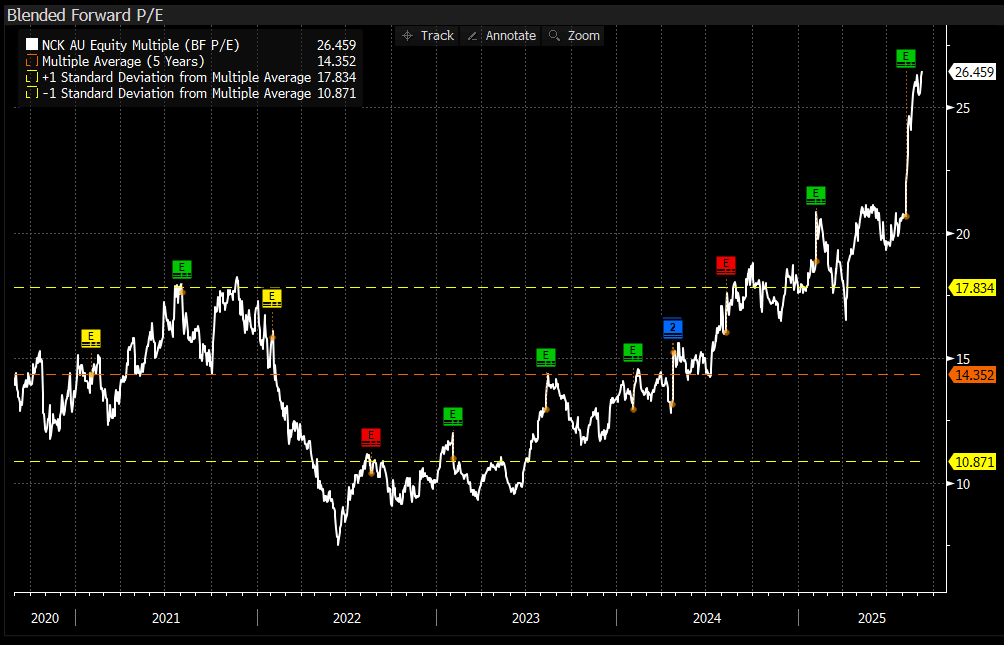

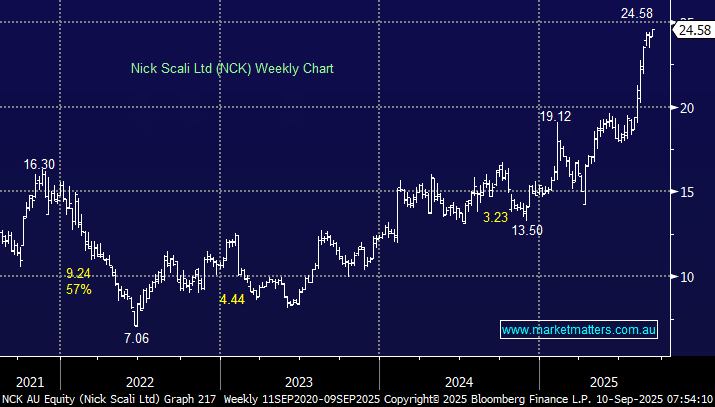

The latest FY25 result was very good; revenue was up +6% to $495m, and while profit fell -28% to $57.7m, this was a result of their UK expansion. Order momentum in 4Q25 and into July was also very encouraging. The solid result and good start to FY26 has pushed NCK to record highs; the stock now trades on ~26x earnings, even at a premium to JB Hi-Fi (JBH) on 24x.

On consensus estimates, NCK is tipped to grow top line revenue at around 10% for the next 3-4 years, and after a dip in earnings in FY25 due to UK related costs, earnings are set to rebound strongly over the next 2-years, up ~20% pa, before a more nominal growth rate around 10% is more likely. The balance sheet is very strong, and we’d go as far as saying that CEO Anthony Scali is one of the best ASX CEO’s around, having taken the top job in 1989 following on from his father Nick. The Scali family still own 7.88% of the business, worth around $100m, having sold ~$50m worth of shares around $11 in 2023.

This is clearly a great story, run by highly effective management with material alignment to shareholders. We can’t fault their execution, and we think the UK represents a very good opportunity for the group. The PE as outlined above will come down as earnings rebound in the years ahead, however, quite clearly, NCK is now a very expensive retailer, and one slip would see a re-rate lower in the multiple the market is prepared to pay for it.

- The bottom line being, that we’re now finding it hard to justify NCK’s current valuation even though the medium-term story is still compelling.