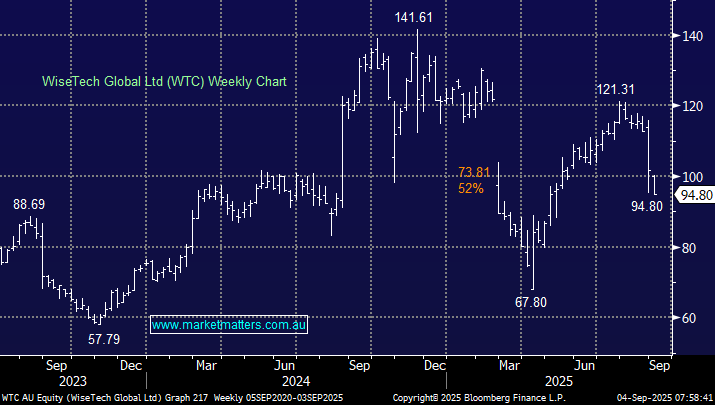

WTC’s result last month was average at best. FY25 revenue missed expectations, and FY26 guidance flagged margin pressure from its e2open acquisition. With distractions subsiding from Richard White’s personal life, this quality logistics business and its founder can get back to focusing on what they do best. Hence, we regard the current weakness as a buying opportunity, with the ~$32bn business now trading over 30% below its late 2024 high.

- We are considering averaging our WTC position around $90, or 4-5% lower: MM owns WTC in its Active Growth Portfolio.