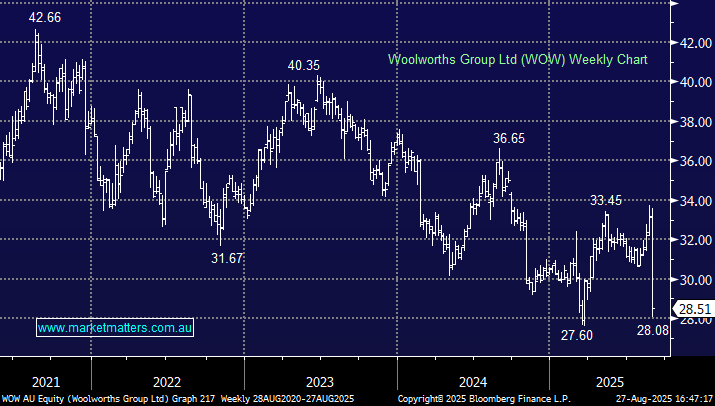

WOW -14.69%: was whacked on its FY26 result showing a steep profit decline and subsequent dividend cut. Its Australian food sales lag behind Coles—WOW was +2.1% versus Coles +4.9%. Woolies’ result showing a 19% fall in net profit couldn’t have come at a worse time, one day after Coles exceeded market expectations. Also, Big W posted a loss of $35 million last year compared with EBIT of $14 million in the year before, while sales rose by 1.1% to $4.64 billion. Margins were the issue, remaining under pressure due to more discounting.

- FY25 Revenue $69.1bn, +1.7% YoY, below $69.17bn estimate.

- NPAT before significant items $1.39bn, -19% YoY, but slightly above $1.38bn.

- Final dividend was 45c, down from 57c YoY.

Australian food sales for the first 7 weeks of FY26 are “well below” Coles as the strong get stronger. WOW expects FY26 Australian food EBIT growth of mid to high single digits, in the $2.9-$3 bn range which is below estimates.

NB We will look at WOW v Couples in the morning, can one keep getting it so right and the other wrong?