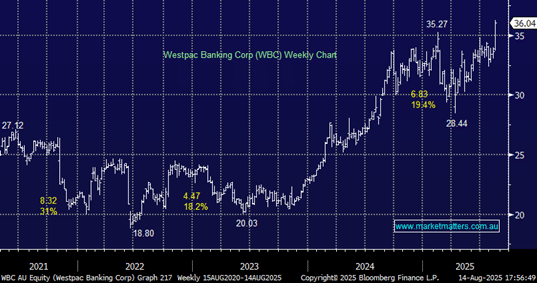

WBC +6.31%: surged following its quarterly update, almost the same amount that Commonwealth Bank (CBA) fell on Wednesday. The market’s fourth-largest stock by market cap tested its decade-high after posting an increase in 3Q profit and net interest income.

WBC reported a 3rd quarter net profit of $1.9bn, increased 5.6% from $1.8bn YoY.

- Net interest margin came in at 1.99% versus 1.92% YoY.

- Lending surged by A$16 billion, and customer deposits grew by A$10 billion.

We liked WBC’s solid update, which allayed fears after yesterday’s CBA report. They posted higher profit and net interest income in the 3rd quarter of FY25, and the bank also reported a capital ratio above its target range. Mortgages taken out directly with the bank comprised 46% of Westpac’s home loan book in the three months to June 30, leaving room for improvement as it wrestles with the mortgage brokers for the more profitable direct business.

We remain bullish towards WBC, continuing to prefer it and ANZ to CBA: MM holds WBC in its Active Growth Portfolio.