- Markets @ Midday Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

- Market Matters Reporting Calendar: Australian FY25 Reporting Calendar in PDF Here & Spreadsheet Here

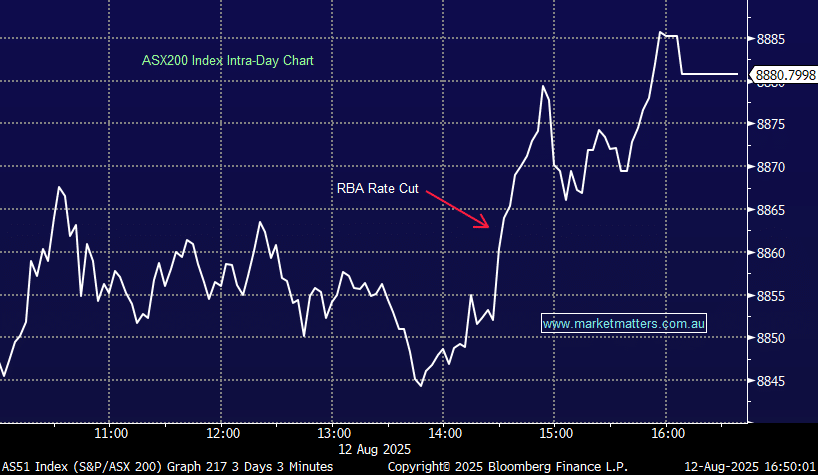

Another new all-time high for the ASX today, buoyed by the expectation that today’s rate cut will be followed by several more; markets now expecting another 3-4 cuts in the next 12-months.

- The ASX200 rallied +36pts/+0.41% closing at 8880

- Utilities (+0.84%), Consumer Discretionary (+0.83%) and Financials (+0.83%) led the line.

- Industrials (-0.85%), IT (-0.16%) and Property (-0.13%) dragged.

- The RBA cut the cash rate target by 0.25% to 3.60%, in line with market expectations.

- The commentary was incrementally more dovish, consistent with downgrades to the growth outlook.

- The commentary implies there is further easing to come, with the market pricing in another 100bps by June 2026.

- Small moves in Aussie Bonds and the AUD following the release at 2.30pm and the presser afterwards.

- SGH –8.5% delivered a strong FY25 result today with earnings up 13% y/y however, guidance for FY26 underwhelmed, an issue for a stock that is well loved (and owned).

- Chrysos (C79) +12.41% had a strong day, on a strong result, the worm has now turned – we’ll cover in coming notes – it’s a stock we’ve owned in the past and like.

- Gentrack (GTK) -3.1% reaffirmed its revenue forecast for the full year, seeing at least $NZ230m. No new news here.

- ANZ Group (ANZ) +2.21% was a strong outperformer in the banking sector, a trend we think has legs based on relative valuation and a better ‘self-help’ story than the other majors.

- Lithium stocks gave back some of yesterday’s gains even as Lithium futures on the Guangzhou Futures Exchange extended gains, although they rose less than daily-limit jump of about 8% seen on Monday

- Pilbara Minerals (PLS) -0.87%, Liontown Resources (LTR) -8% and Mineral Resources (MIN) –1.63%.

- MIN also saw a downgrade from UBS from hold to sell, so held up well considering.

- JB Hi-Fi (JBH) +5.58% rallied back after losing 8.4% yesterday – Macquarie has turned more positive – upgrading to outperform with a $118 PT.

- CAR Group (CAR) +5.03% as also solid on a broker upgrade – this one has been interesting over the last 24 hours, the first reaction of a sell-off has now given way to strong buying and a breakout of its range. RBC raised to buy and $41 PT

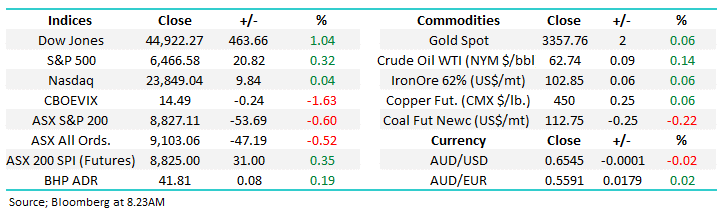

- Gold up $4/oz during the session, trading around $US3347/oz at our close.

- Mixed trading in Asia, Hong Kong was flat, China up 0.4% while Japan had a great day up +2.2%.

- Iron ore rose for a second day, on expectations that the Chinese government will enforce steel production cuts ahead of next month’s military parade in Beijing.

- Singapore futures traded above $104 a ton