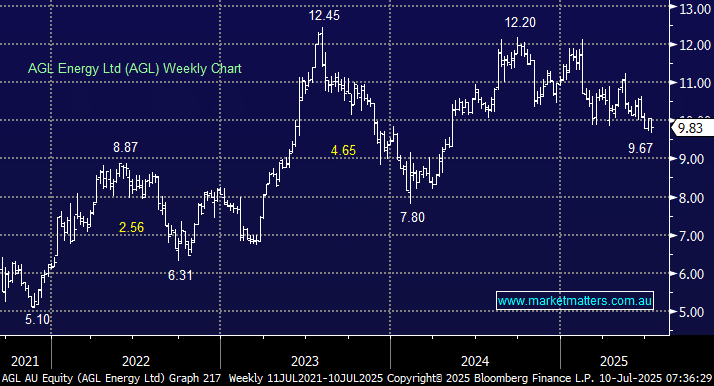

AGL has fallen 12.9% so far in 2025, the sector’s standout underperformer, and it tested new 12-month lows this week. AGL disappointed the market in February, and it hasn’t recovered since: for the first half of FY2025, AGL reported a 7% decline in underlying net profit after tax, and while revenues exceeded expectations, earnings per share (EPS) fell well short, indicating margin pressures. The obvious question is, have the pessimists gone too far before next month’s full-year result? The stock is forecast to yield close to 5% over the coming 12-months while trading around ~20% ‘cheap’ on a PE basis suggesting an ok result will be enough to drive the stock higher.

Margins are the key to the share price’s future, and they’ve been hit recently due to competition in the retail sector, wage costs, the Australian Energy Regulator’s involvement in pricing, and the company’s ongoing investments in renewable energy projects. We don’t believe any of these headwinds are going to disappear in a hurry, though, we do believe that AGL is trading on a very attractive valuation relative to a likely (gradual) recovery in earnings from FY26 onwards (after a slight dip in FY25).

- We like the risk/reward towards AGL below $10: MM owns AGL in its Active Income Portfolios.