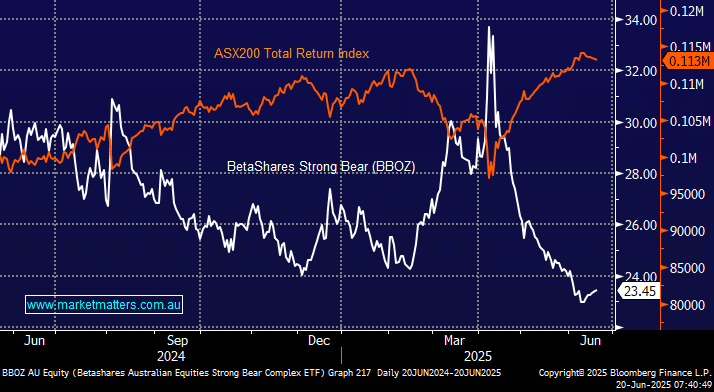

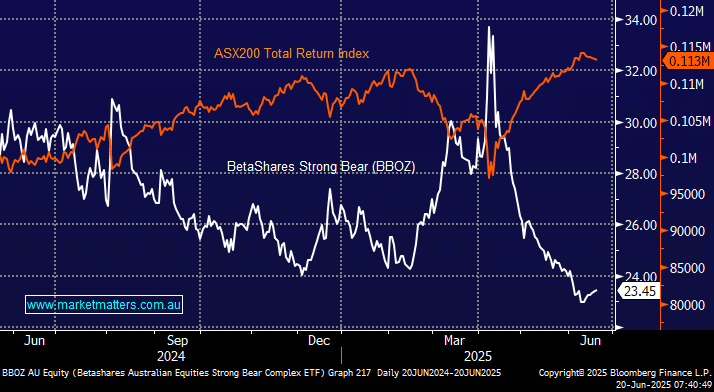

The BBOZ is akin to getting the One-Wood out on the golf course with its leverage of around 2x leading to significant moves in opposite directions to the ASX200. This time, when the ASX200 corrected by almost 17%, the BBOZ ETF spiked up over 45%, a great return for those who exited early on the market’s nadir. Note that the extreme high in the BBOZ occurred when the stocks were opening based on the futures, hence the return was well over twice the pullback experienced by the actual stock market. This ETF has declined by almost 90% since the COVID-19 lows in stocks, illustrating its more aggressive short-term nature, unless we are in a prolonged bear market, with its 1.38% fee also weighing on performance.

- We believe it’s too early to consider the BBOZ, but it may be an option at some stage through 2025/6.