MM’s thoughts on the BBOZ ETF?

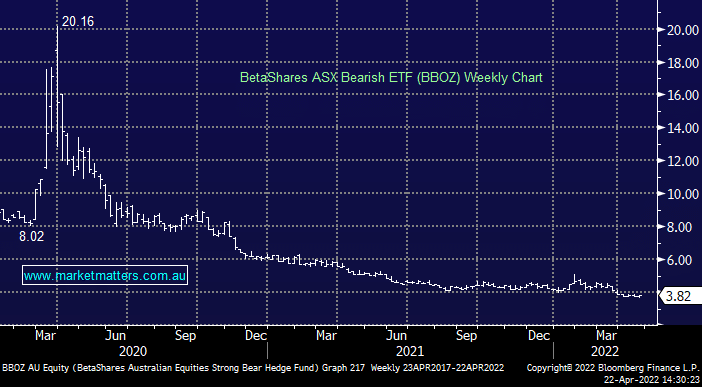

Hello James and team, Cheers for your tip on WHC. I have nearly sold out now and the results are very pleasing. As you have moved down the risk curve by moving out of well performed mineral stocks and into more defensive stocks I'm considering how to also replicate this approach in my portfolio. Can you give me your thoughts on BBOZ and is it good timing to commence accumulating this stock given the All Ords is nearing a record high? Thanks and regards Rob