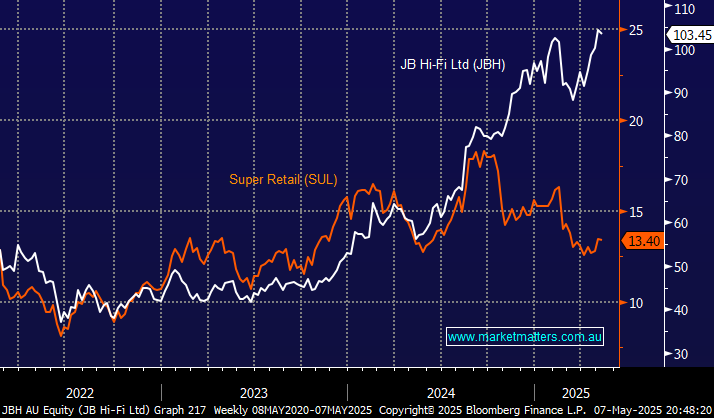

JBH experienced a sharp initial 6% decline after the retailer reported 3Q sales growth that was lower than their last update in January (6% vs 7.1% prior run-rate) with The Good Guys a major reason, although virtually all of the knee-jerk bearish reaction had evaporated by the market’s close. Some downgrades followed, but the stock shrugged them off, ending the session almost unchanged. Unfortunately, this is a great company, but it’s priced accordingly and we don’t see compelling value around $100. CEO Terry Smart said the market remains “challenging and competitive”, not exciting rhetoric for a stock trading close to its highest ever valuation.

Conversely, SUL has struggled this year after a poor trading update in February, combined with the news that UK retail giant Frasers announced an aggressive plan to take on Rebel in Australia with 100 Sports Direct Stores. While the risks add up that SUL has underperformed JBH over the last six months, we believe the elastic band has stretched too far.

This morning, SUL released a trading update that showed a mild improvement in group sales growth to a year-to-date run-rate of 4.2%, though they flagged softer margins, an increase in costs, and some mixed fortunes across their stable of brands, with BCF the star while Macpac struggled. Overall, there doesn’t appear to be a catalyst to address the recent underperformance in today’s update!

- We would need the gap between SUL and JBH to close before considering a switch: We hold SUL in our Active Growth and Active Income Portfolios.