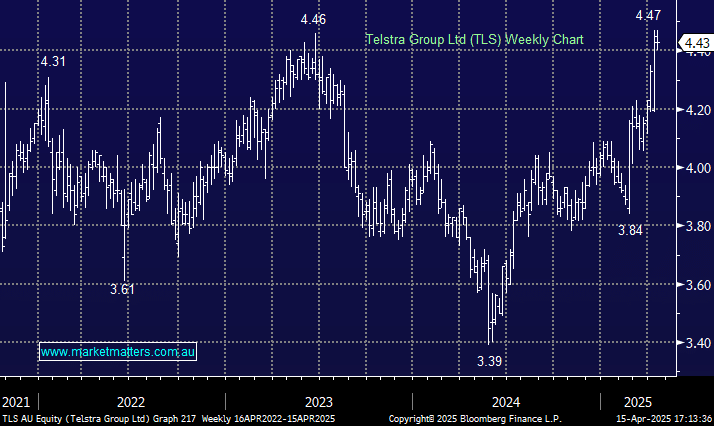

This month, TLS hit our initial $4.40 target area, raising questions about whether it was time to sell. The Telco giant is forecast to yield 4.40% fully franked over the coming 12 months, with its next dividend due in August. This remains attractive to us when the RBA is expected to cut the cash rate this year to 3.35% or even lower. The stock has also benefitted recently from its “safety/defensive” nature while tariff uncertainty rolled through markets; the ASX200 is down 4.9% year-to-date, while TLS is up +11.4%.

- We see no reason to sell/switch this solid-yielding defensive Telco when a runaway bull market or interest rate hikes feel highly unlikely, even though we are net bullish stocks.

Also, in February, TLS delivered a clean, good result, with no negative surprises, plus an increased interim dividend and a $750m on-market buyback. We see scope for upside on mobile, AI and further capital management, which might be communicated at T28 in June i.e. Telstra’s upcoming strategic 3-year framework. Moving forward, TLS is expected to grow earnings and dividends, the main reason people own the stock, consistently from 19c in 2025 to 24c in 2030. These aren’t numbers to compare to high-growth names in the tech sector, but they’re attractive from a steady income perspective unless we enter another rate-hiking cycle.

- We continue to like TLS for its sustainable yield and are now targeting the $5 area: MM holds TLS in its Active Income Portfolio.