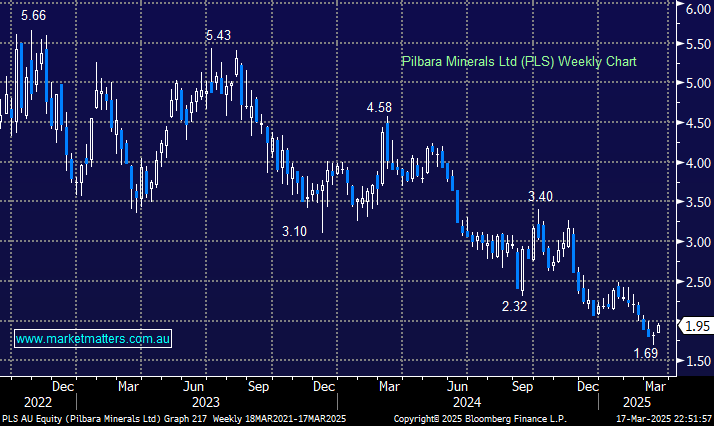

PLS jumped +7.1% on Monday, following on the heels of Mineral Resources (MIN). The company’s recent December quarterly production and activities report was okay and arguably better than expected for a stock that’s collapsed over recent years. While production was lower for the second consecutive quarter, costs rose modestly, and PLS’s much-vaunted cash pile shrunk; several aspects of the release beat market expectations and bargain hunters appear to be again considering the stock. It’s an aggressive play, but we now like PLS with a classic “DOJI” (candlestick charts) formed on the weekly chart for technical analysts.

- We can see PLS testing $2.50 and, potentially, $3 in the coming months, assuming it holds above $1.75, which is a pretty attractive risk/reward.