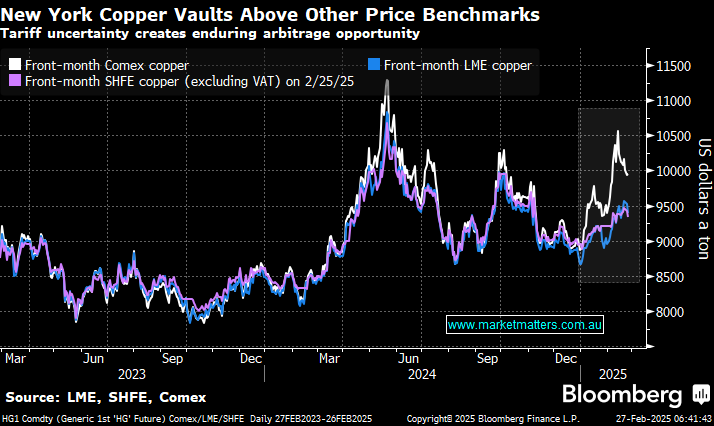

Copper futures initially surged after President Donald Trump ordered the US Commerce Department to examine possible import tariffs on all forms of the metal. The move was the latest in a string of steps to impose sector-specific levies to protect US producers and remake global supply chains. Copper markets have already experienced significant dislocations this year as traders bet on tariffs, opening a gap between prices in America and the rest of the world. Copper futures traded on the Comex in New York rose 4.9%. Shares of US-traded copper miners also climbed on the news, with Freeport-McMoRan Inc. jumping more than 6% in after-market trading, but gains were pared during the US trading session with the headlines being dismissed as ”old news”. Trump is causing Cu to trade in unusual ways, upending normal trade flows:

- Commodity traders are shipping CU to the US from around the world ahead of Trump’s tariffs, creating opportunities for commodity traders.

- The gap between Cu in the US and the rest of the world has widened to more than 10%, with US prices trading at a significant premium.