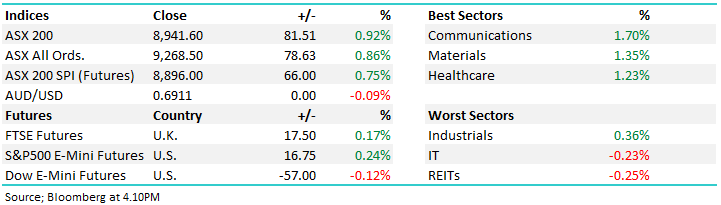

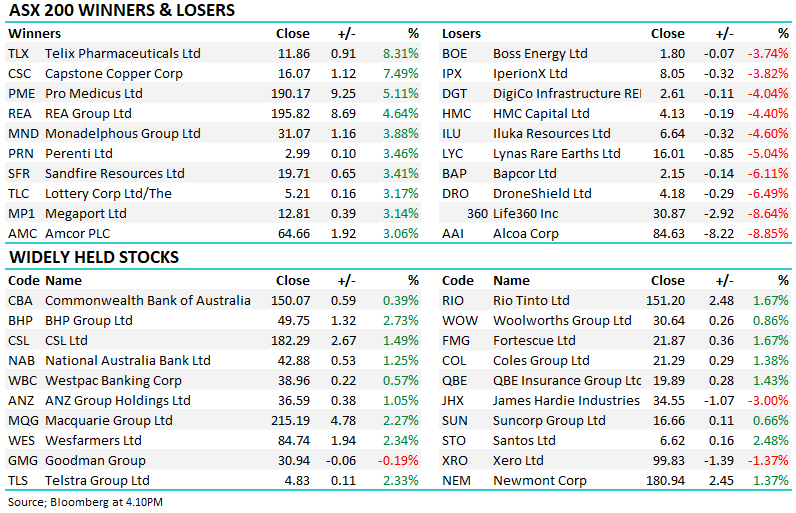

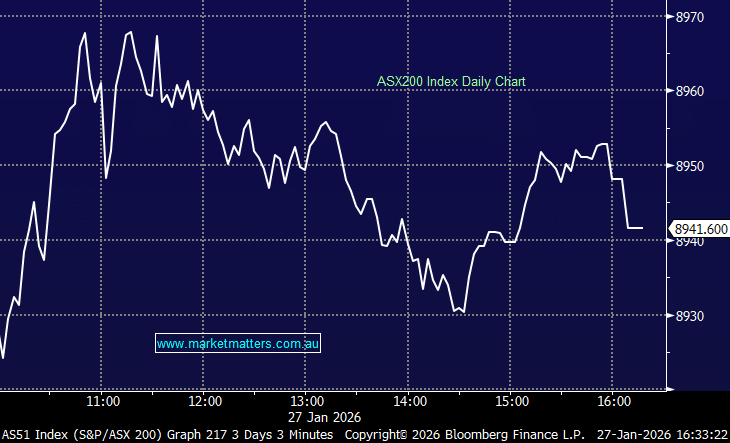

The ASX200 fell 0.66%, with losses compounded by the RBA’s less-dovish or arguably hawkish commentary after the rate cut. Weakness was noticeable in the rate-sensitive banks and retail stocks, with CBA, NAB, and WBC contributing more than 60% of the main boards’ fall. Bendigo (BEN) and Westpac (WBC) both fell 3%, adding to Monday’s drop following disappointing reports – even the banks aren’t attracting buying if they miss estimates.

The large-cap iron ore stocks enjoyed another relatively strong day, with BHP gaining 0.4% after the Big Australian delivered an inline result, Fortescue (FMG) up +0.3%, and Rio Tinto up +0.4%. We liked what we heard from BHP chief executive Mike Henry, who said he saw “early signs of recovery” in the Chinese economy. This echoes our comments in recent months and is the obvious catalyst for pushing the ASX miners higher, along with the market’s underweight stance toward commodity stocks.

US markets reopened after the President’s Day long weekend in mixed fashion, with the NASDAQ gaining 0.2% while the Russell 2000 small-cap index advanced +0.45%. The Dow was little changed Tuesday, trading near its all-time high as stocks stay resilient despite rising global trade fears and persistent inflation worries. Twenty-two S&P500 stocks, including Goldman Sachs (GS US) and Deere (DE US), posted fresh highs. Elsewhere, Chipmaker Intel (INTC US) soared 10% after The Wall Street Journal reported that rivals Broadcom and Taiwan Semiconductor Manufacturing are exploring potential deals that could split the company up, and Nike (NKE US) popped 4.5% after announcing a new brand in partnership with Kim Kardashian’s Skims shapewear company.

Most European bourses continued their march higher, with the EURO STOXX 50 closing up +0.25%, although the UK FTSE finished flat.

- The ASX200 is poised to open flat this morning following the quiet session overseas; BHP was down a few cents in US trade.