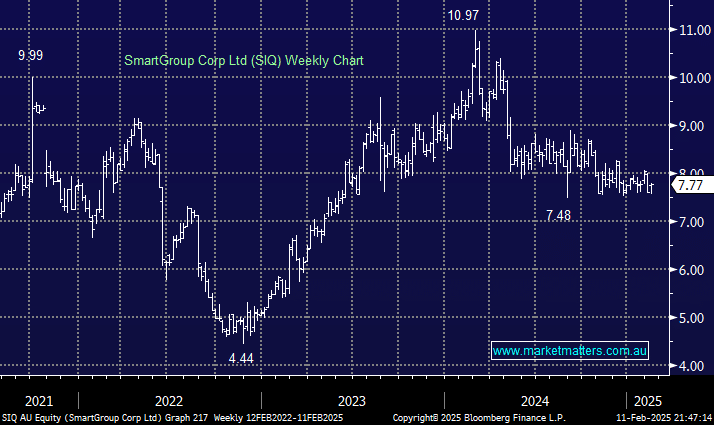

It’s been a disappointing year for car leasing and salary packaging operative Smart Group (SIQ), with shares down 17% over the past 12-months in a rising market. Dividends have helped, with the stock paying out 49.5c fully franked including a special dividend in March. We note that Bell Potter downgraded competitor McMillan Shakespeare (MMS) last week, pushing shares lower, and their rationale is worth taking note of when we consider whether to hold or fold on SIQ ahead of their FY24 results due before market open on the 26th February (SIQ are a December year-end).

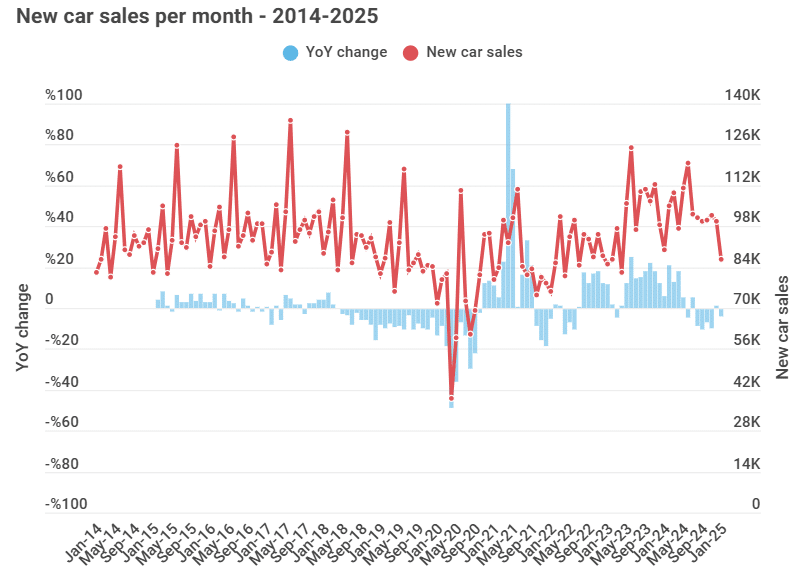

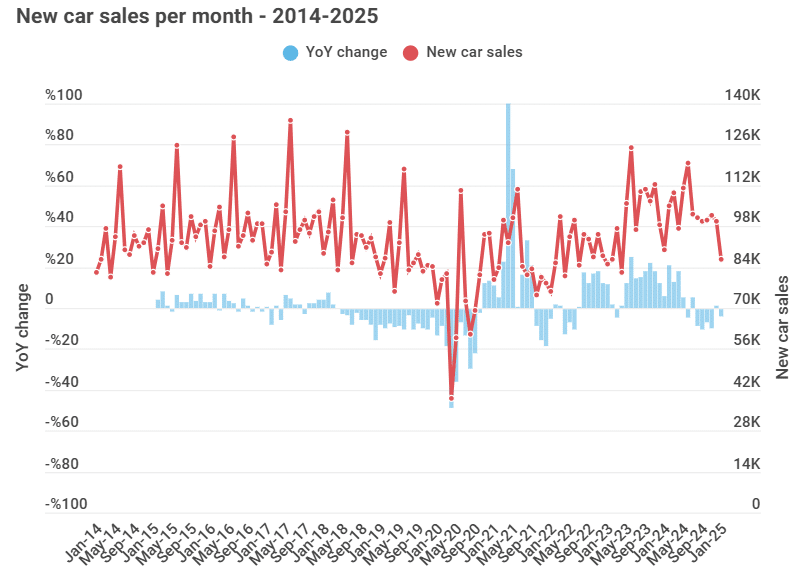

The crux of the MMS downgrade was predicated on weakening sales of new vehicles. While sales broke their annual record for the second year in a row in 2024, it was hardly convincing, topping the milestone by just 1.7%, and the trend in the back half of the year was soft, with five months of consecutive decline.

The data showed a -3% YoY reduction in the 6-months to December for Passenger and SUV sales, with private sales down sharply (-12% YoY). EVs accounted for 9.5% of new light-duty vehicles, marking an improvement from 8.4% in 1st half of the calendar year and driven by the introduction of more plug-in Hybrid EV models. Further, Bells did some analysis on port data, with port Melbourne and Kembla data showing a -9.9% YoY decline in imports. With sales softer in the back half of the year, but only by ¬3%, and imports down more like 10%, it indicates delivery times (and carry-over) have reduced. This should mean that actual sales have grown in the 2H, which is good for earnings (now); however, the trends look to be softening. On that basis, we think there are some risks around commentary/guidance for the year ahead.

- While Smart Group (SIQ) is trading at the cheaper end of the spectrum, on an Est PE of 13x and a very good yield when we include likely special dividends, we question whether or not taking the risk and holding into the result is sensible.

Easing monetary policy will help, with the RBA set to lower rates before SIQ reports their numbers. However, rate reductions take time to affect purchasing decisions for large items such as cars. Weakness in the used market is also a red flag, with car owners more reluctant to buy new when it’s harder to sell their existing ride.

- On the basis of probabilities, we believe it’s more sensible to heed these trends, and take a small loss in the Income Portfolio on our SIQ position before they report – watch for alerts.