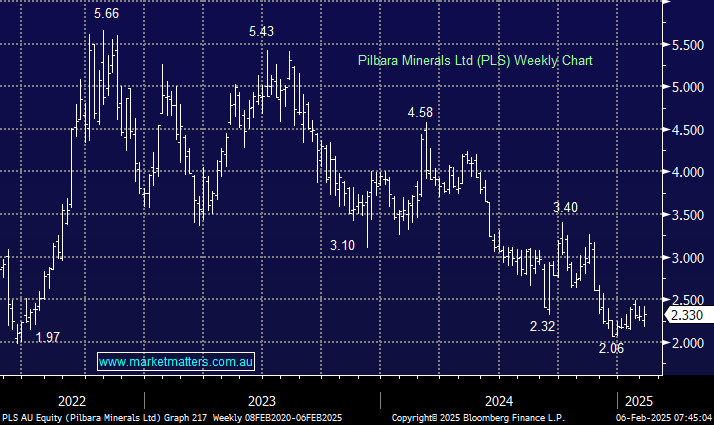

Australia’s largest pure Li play PLS is up over 6% so far this year, outperforming the ASX200 which has gained +3.2% helped by a December quarter which showed a solid set of results. While production and sales were down quarter on quarter, the spodumene sale price showed improvement with a realised price of US$700/t (A$1124) spodumene concentrate, up from $US682 in the previous 3-months and 11% above analyst expectations. These numbers compared favourably to an operating cost of A$621/t with marginal QoQ increases due to lower production. Importantly, these numbers show that PLS can survive even with current depressed Li prices which saw Goldman upgrade the stock to neutral on Wednesday, not too exciting.

- We agree with CEO Dale Henderson that the lithium rout is now over with December potentially a decent inflection point after 18-months of broad-based decline.

PLS has insulated itself from the Li collapse by mothballing its Ngungaju plant in WA and cutting production of the battery materials. It has a healthy cash balance of A$1.2bn at quarter end with the business focusing on preserving capital until Li turns. However with China demonstrating what can unfold when the adoption freight train picks up momentum, we believe PLS will be higher in the coming years. We like PLS given its ability to quickly ramp up production, if/when we see a lithium price recovery.

- We can see PLS trading above $3 in 2025 but its likely to be a volatile journey.

NB PLS remains Shawn’s top Trading Idea added at $2.15. Suggest raising stop today to $2.17, this weeks low.