LTR has surged over 28% in 2025, albeit off a low base, illustrating the potential upside from current levels. Last month the Li producer surprised the market with better than expected Spodumene volumes, in its 2nd quarter production report, while underground mining progressed with the first shipment scheduled Q4 FY25. Currently high All-in-sustaining-cost (AISC) of $1,170 per tonne has huge room for improvement towards their guided 2H A$775-$855 per tonne – hence we like the upside.

There’s also the small matter of Gina dominating the share registry, perhaps if she believes Li has bottomed a takeover may follow.

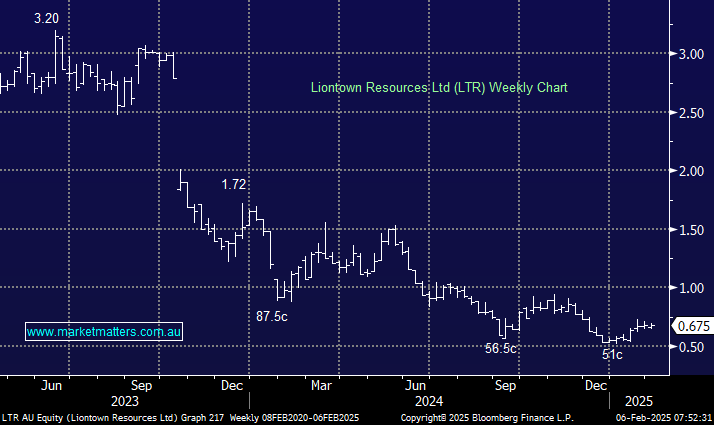

- We can initially see LTR testing 85c in 2025 although much higher levels wouldn’t surprise – MM holds LTR in our Emerging Companies Portfolio.