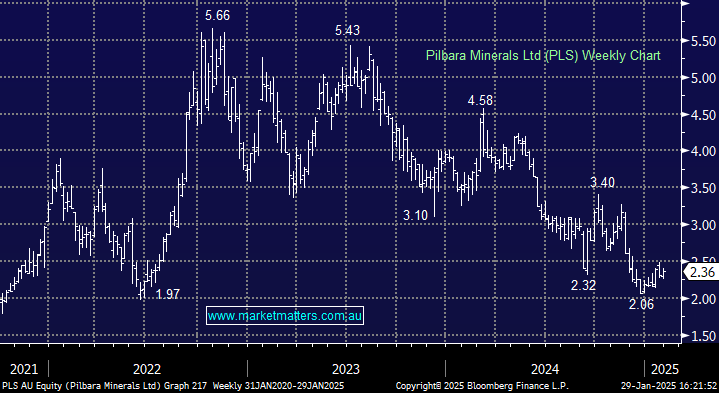

PLS +3.51%: The December quarter delivered a solid set of results. While production and sales were down quarter on quarter, spodumene sale price showed improvement.

Key highlights:

- Spodumene concentrate production of 188.2k and shipments of 204.1kt.

- Realised price of US$700/t spodumene concentrate.

- Operating cost of A$621/t with marginal QoQ increases due to lower production.

- Cash balance of A$1.2bn at quarter end.

PLS have adjusted their offtake contracts to align with the current market. Promisingly we are seeing price recovery with price levels seeing an 18-month long decline and now seeing a small rise since October. Given its robust balance sheet and ability to quickly ‘turn the tap on’ with its production, the miner remains well placed to seize the opportunity in the event of a lithium price recovery.

- PLS remains Shawn’s Top Trading Idea