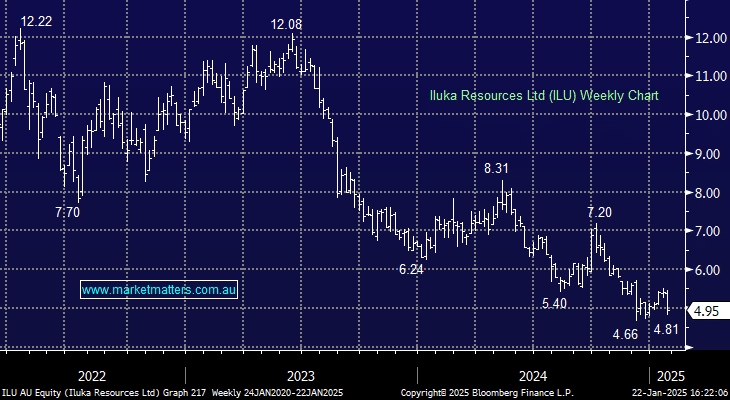

ILU –6.95%; Challenging conditions remained in Q4 for ILU with Mineral Sands below expectations despite seeing some sales growth (25%) relative to Q3. The same was true for aggregate Zircon/Rutile/Synthetic Rutile, around 10% below expectations but up 40% on Q3, while pricing was generally on the softer side, other than Rutile which was a touch stronger. They said prices would remain under pressure in Q1, though sales volumes were improving and initiatives on the cost side have worked to lower unit cash costs.

In terms of market commentary, they said the Chinese ceramic industry had scaled back production in the period and the majority not opening back up until after the Chinese New Year, while the residential property market in has shown signs of stabilising.

Clearly, things are still tough for ILU and they need better prices, but volumes are on the up and there are some early signs of improvement. The stock price down today is understandable, however looking ahead, China must support the property market further, and ILU remains a very leveraged play on that theme.