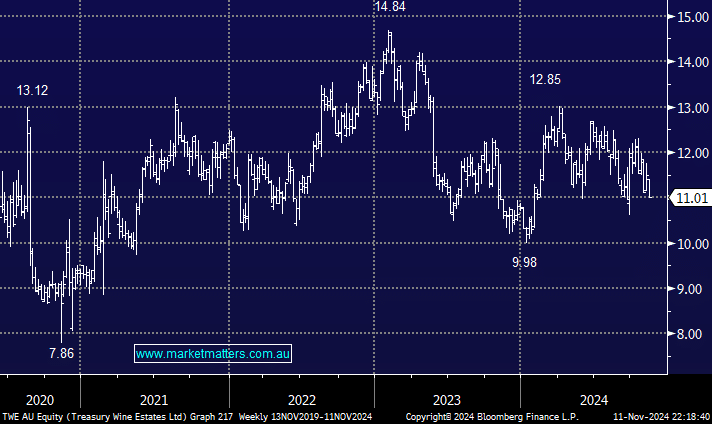

Unfortunately, not our worst-performing stock in the MM Growth portfolio but it keeps disappointing and it’s potentially in the crosshairs of Trump tariffs. After crippling Chinese tariffs in 2020, TWE reinvented itself with over 50% of revenue now coming from the Americas and it’s now potentially walked into Tariffs – Mark 2, with Trump likely to impose a 10% tariff on imported wine, plus we may be at the start of a whole new trade war with China – it’s feeling a touch too hard for TWE.

- We like TWE, but cannot help but question if our funds would be better deployed elsewhere.