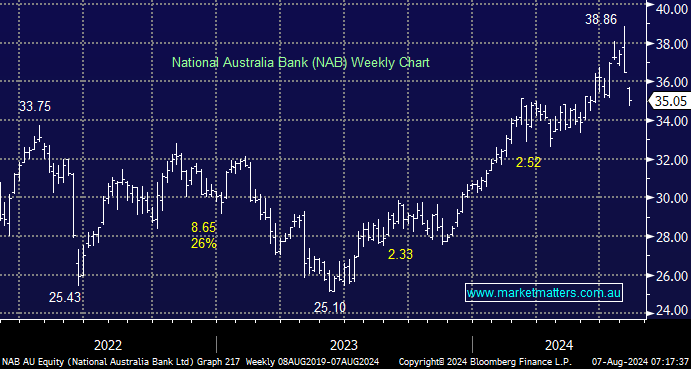

On Monday, we sold NAB from our Income & Growth portfolios to 1. To mildly increase cash/flexibility given the big change in the macro backdrop & 2. To ultimately rejig our banking exposure away from NAB after its ~30% rally this year.

- Why have we singled out NAB as the bank to sell?

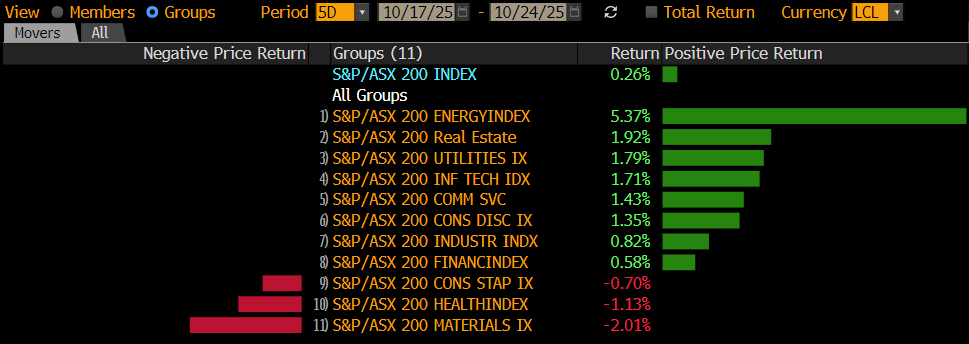

Business & Private Banking make up around 44% of NABs earnings, compared to Personal Banking (~14%), Corporate and Institutional (~24%) & New Zealand (~18%), i.e. it’s a big chunk, with NAB having built its reputation as the business bank of choice over a long period, however, with intense competitive pressures in personal banking/mortgages, we’re seeing a rejuvenated focus from the other majors towards business banking. While NAB won’t give up market share without a fight, and the new CEO Andrew Irvine has reinforced their strategy in this area, we think more investment and a stronger focus from the likes of CBA towards business banking will hurt NAB from a relative standpoint.

CBA is not the only bank targeting this area, as it makes a lot of sense. Margins are better and the risk when lending to a business banking customer is lower, given the bank has all the transactional data. CBA’s strategy here is deposit & transaction-led, insofar as if they get more businesses to bank with them, they can create better offerings on the back of it i.e. they have the data to make more informed decisions. They already have over 20% of the business deposit market and account for ~18% of business lending. However, there is room to take market share from NAB. Technology is at the centre of this growth, providing businesses with specific technology platforms in areas like hospitality, medical insurance, real-estate & property management, which have traditionally been strong areas for NAB.

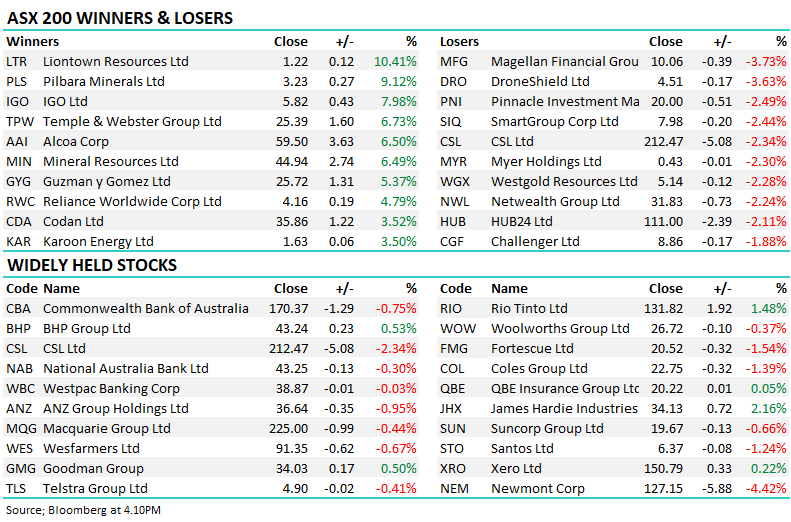

Banking is now a tech-focussed operation, and we think the winner in technology, will be the winner in banking. NAB is arguably underspending in tech relative to its size, while scale counts, and CBA has that. For now, we elected to take profits in NAB after a strong period for the majority of the sector. The Income Portfolio still holds CBA, while the Growth Portfolio still holds ANZ.

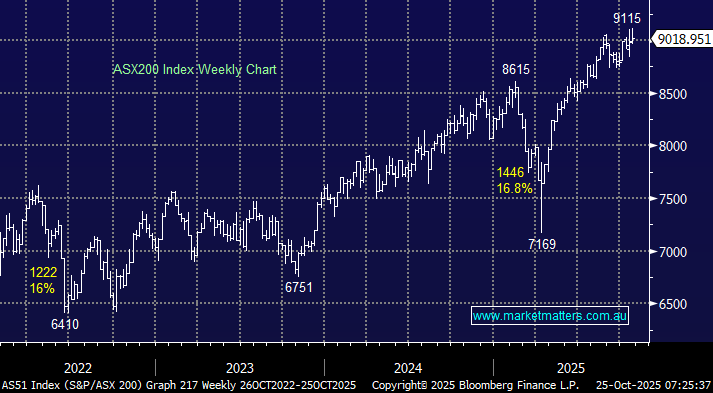

3 of the 4 major banks are expensive, even after the sharp pullback this week.

- NAB trades on 15.4x 1 year forward PE making is over 1 standard deviation ‘expensive’, or about 15% above average.

- CBA trades on 22.31x 1 year forward PE, making it 2 standard deviations ‘expensive’, or about 23% above average.

- WBC trades on 14.6x , 1 year forward PE, making it 1 standard deviation ‘expensive’, or about 14% above average.

- ANZ trades on 12.2x, 1 year forward PE , which is only 2% above its usual multiple.

ANZ has not participated in this year’s bank rally to the degree of the others, up ~10% relative to a typical ~30% move. They have challenges with the acquisition of Suncorp’s banking unit and are now dealing with ASIC on alleged bond price manipulation. This has created some relative value across an expensive sector in the near term.

- Distilling this down, banks have had a phenomenal period, and in the short term at least, taking some profit and increasing flexibility makes sense to MM, with a rejuvenated competitive landscape towards NAB’s very important business banking dominance the key reason it was singled out.