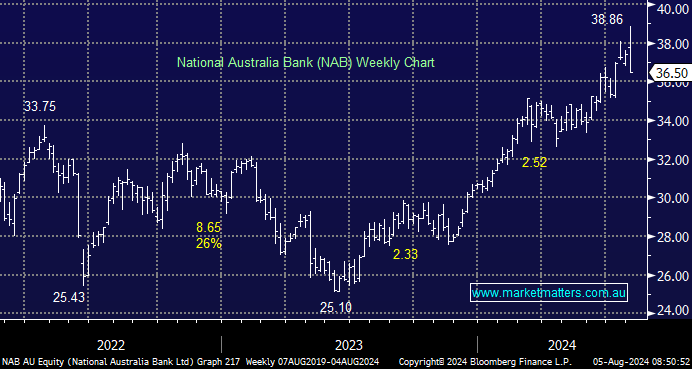

We have turned neutral the broader market and would like to have more cash in portfolios at this juncture. NAB has outperformed peers, yet, we believe it has increasing competition in business banking. NAB has become our least preferred banking exposure, and we are now taking profit, selling our 6% holding in the Growth Portfolio & our 7% holding in the Income Portfolio.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM are selling NAB in the Active Growth & Active Income Portfolios, taking profit around $36

Add To Hit List

Related Q&A

Bank Stocks

Banks – so strong!

NAB Bank

Where to on the Banks (Big 4 )?

Thoughts on Bank Dividends in May

December Dividends

What are your Santa Rally Expectations?

Thoughts on the Big 4 Banks into November

Are Bank/hybrids safe?

Q&A for Sat Weekend report – Banking Sector (ANZ, NAB, WBC,CBA)

What’s MM current view on the BIG 4 Banks (ANZ, CBA, NAB, and WBC)?

Can you expand on your thoughts towards banks please?

Does MM like the 4 Big Banks (CBA,NAB,ANZ,WBC) into current strength?

Thoughts on NCM, WOS and NAB please?

What are MM’s thoughts on the “Big Banks”?

Which Banks to hold

Favourite banks into the reporting season + dividend/reporting plays

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.