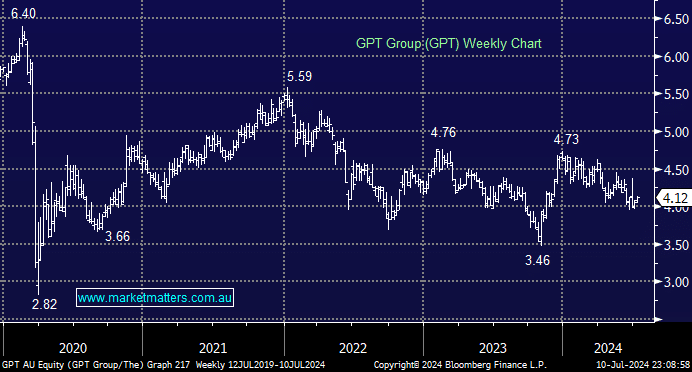

As subscribers know, MM’s preferred scenario is that the RBA doesn’t hike interest rates in 2024, which should provide a tailwind for GPT. The business is an active owner and manager of a diversified portfolio of Australian property assets, including the MLC Centre & Australia Square in Sydney and Melbourne Central. From a valuation perspective, the stock is trading ~13% cheaper than the average of the last 5-years which makes sense for a market concerned about rate rises, but if the RBA’s next move is a cut, as we believe it will be, then the stocks cheap – we can see a test of $5.50 over the coming years. Patient investors will also be rewarded by a forecasted yield above 6% over the next 12 months.

- We already have decent real estate exposure across the MM portfolios, and if we decide to increase it further, GPT is an option.