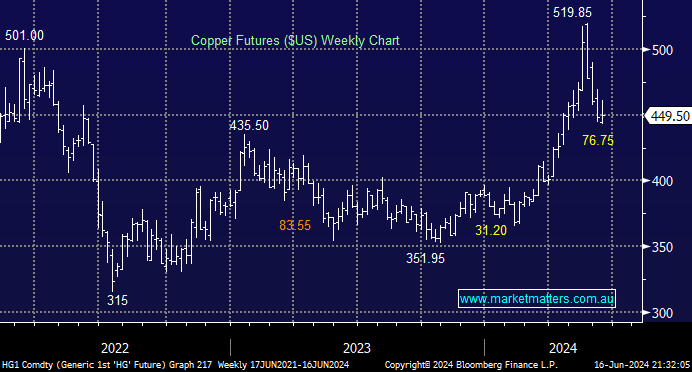

Copper (Cu) has corrected almost 15% over the last few weeks, falling almost as sharply as it appreciated from its late 2023 swing low. It’s been a volatile ride for the industrial metal, but we believe it’s now due to consolidate in the $US4.50-5.00 region after its “blow off” top above $US5.00, one we called at the time.

- Based on simple supply and demand fundamentals, we believe Cu will trade higher over the coming years – we like it around $US4.50.

Brent crude advanced back above $US80 last week, snapping its three-week losing streak on hopes that summer oil demand will draw down inventories. Oil remains well below its highs set in April, but sentiment has soured across the whole commodity space over recent weeks, especially towards oil after OPEC+ unveiled plans to increase production in the 4th quarter. However, we remind subscribers that “lows” are often formed on such snippets of news.

- We believe crude oil is “looking for low”, and the last two weeks have encouragingly seen the energy complex gain strength around the $US80 area.