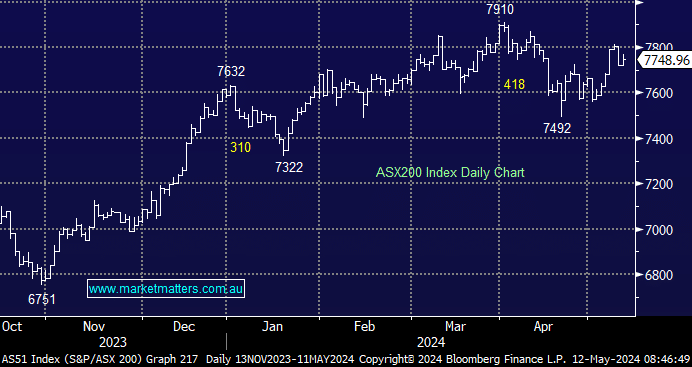

The ASX200 rallied +1.6% last week, even after a sharp drop on Thursday when the retail and banking sectors came under pressure. By Friday’s close, 10 out of 11 sectors on the main board had closed higher, although 27% of ASX200 stocks closed lower over the five days. This illustrates that we are in a “stock pickers” market after the market’s +15% rally from its November low. We anticipate ongoing volatility through 2024, primarily on sentiment ebbs and flows around interest rates.

- The SPI Futures are pointing to a -0.2% dip this morning, which feels a touch bearish considering the solid night on Wall Street and BHP’s 40c gain in the US.

- However, the government will likely “flash the cash” in Tuesday’s budget. If it’s too generous ahead of next year’s election, it’s likely to weigh on rate cut expectations.

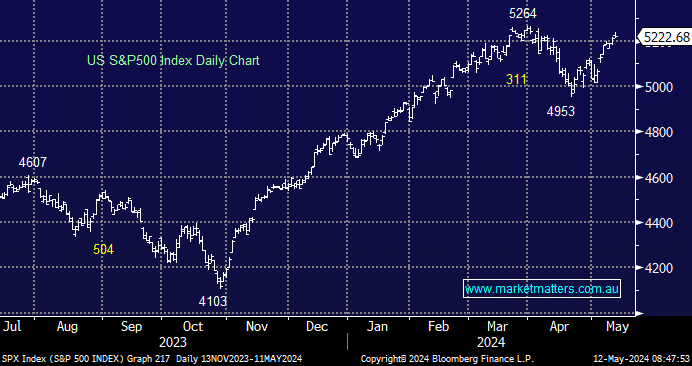

US equities continued their stellar start to May, with the S&P500 advancing +0.2% on Friday. This took its gain to +3.7% month-to-date while it finished less than 1% below its all-time high set in late March. Markets will likely start this week in quiet fashion ahead of Wednesday’s important US CPI, the next read for the FED on inflation. A figure below the expected 3.4% is likely to catapult stocks to fresh highs, no big call from current levels.

- We are targeting the 5500 area for the broad-based S&P500 over the coming weeks/months, or around 5% higher.

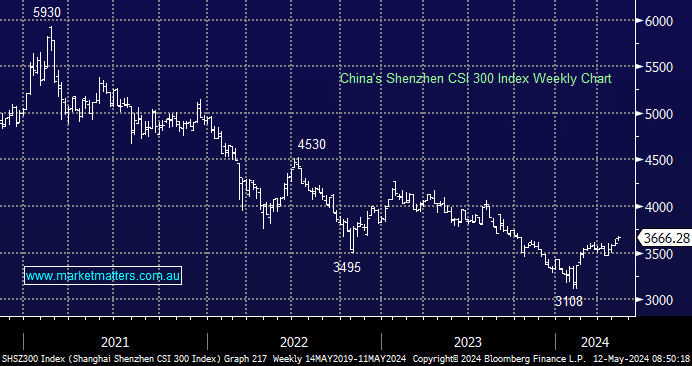

Chinese equities closed at fresh 7-month highs last week as they continue to rebound from their painful 3-year decline. While we must remain aware that Beijing has been flexing its muscles to support its local stock market, so far, it’s been working, and we wouldn’t advocate fighting Beijing or the Fed when they put their minds to achieving certain economic goals.

- We are bullish on Chinese stocks, initially targeting the 4000 area or 10% higher – a bullish read-through for our local Resources Sector.