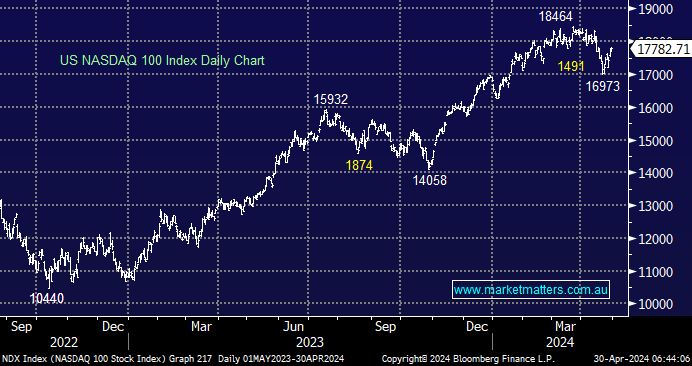

US stocks improved overnight, with all three major U.S. indexes rising modestly to start a big week for earnings and economic updates. Earnings season will commence in earnest tomorrow when results from Amazon.com, McDonald’s, and Coca-Cola are delivered. The FED’s policy announcement on Wednesday is likely to show if investors are correct to be losing hope of interest-rate cuts in 2024, while Friday’s jobs report will give more clues on the strength of the US economy.

- The tech-based NASDAQ is again less than 4% below its March all-time high, even after Meta’s very disappointing report last week.

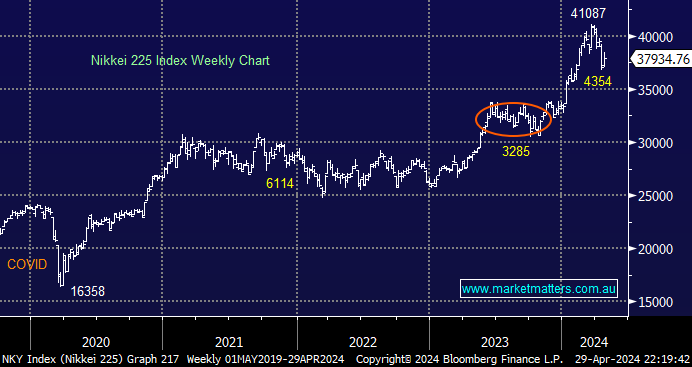

The Japanese Yen went on a wild ride during yesterday’s trade after hitting more than 30-year lows before rumours of intervention by the Bank of Japan (BOJ). A degree of stability in its currency may provide the catalyst for the Nikkei to recommence its impressive bullish advance following its more than 10% pullback.

- We can see the Japanese Nikkei making fresh all-time highs in the coming months.