The Greenback consolidated around its 2024 high, with all eyes on Jerome Powell later this week. If he suggests rates might not fall in 2024, a test by the $US of its 2023 high could easily unfold. Locally, we’ve witnessed markets lose confidence that rates will be cut in 2024, whereas the US has only seen hopes fade from 3 cuts to 1 or 2. A shift to zero would likely lift volatility across financial markets into the EOFY.

- No change; we remain net bearish on the US dollar through 2024/5, but for now, it looks comfortable around 106.

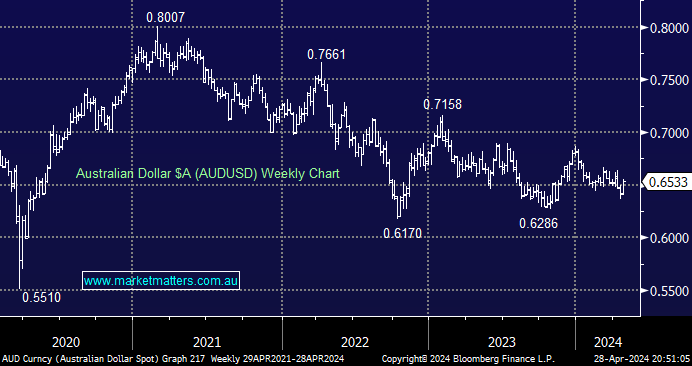

Following last week’s hot CPI, the lowered hopes of a rate cut by the RBA anytime soon gave the $A a solid lift. Although the local currency has hardly moved over the last few years against the greenback, versus the Yen, it’s now trading at decade-highs. Further signs that the Chinese economy is improving will offer a tailwind for both the $A and the local resources stocks, but it’s not in a hurry to move anywhere at this stage.

- We can see the $A testing 70c through 2024/5.