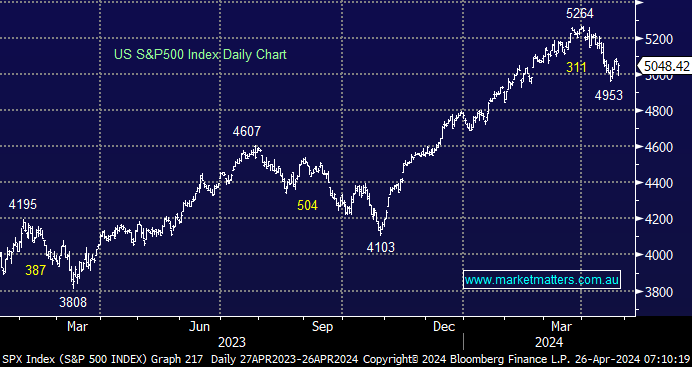

US stocks recovered strongly from their initial aggressive sell-off following the META result and, significantly, average guidance. If we exclude last night’s tough tech session, it was a balanced session for US stocks, with 5 of the main 11 sectors closing higher, led by the resources, which should bode well for the likely names ex-BHP. Reporting season is delivering its usual volatility under the hood, but we don’t see any major concerns at the index level.

- We continue to believe that US stocks are enjoying a bull market until further notice. Our preferred roadmap sees the S&P500 again making fresh all-time highs in 2024/5.

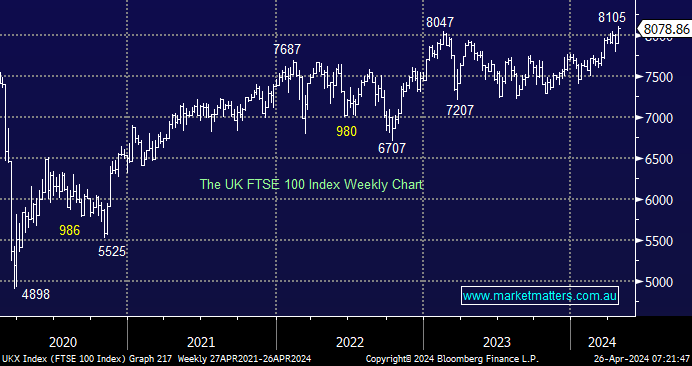

The UK FTSE again posted new all-time highs overnight, benefitting from its significant resources weighting with the takeover of AAL also helped the market sentiment. We believe the UK FTSE will continue to outperform US stocks as the tech advance rapidly starts to tire.

- We remain bullish towards the UK FTSE, a positive read-through on the highly correlated ASX.