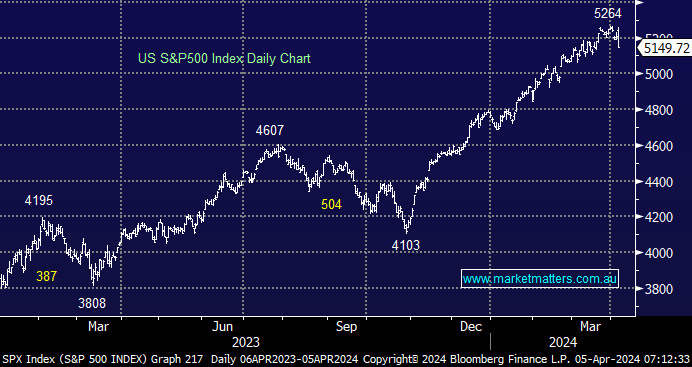

US stocks were sold off overnight as investors realised that 2-3 rate cuts were far from guaranteed in 2024. This is a healthy reality check, in our opinion. Selling intensified into the close ahead of the March jobs report due on Friday; investors are positioned for rate cuts, and the risks of them not materialising are increasing weekly as Fed officials continue to reiterate a cautious message. A jump in oil to its highest level since October also increased concerns that inflation will reaccelerate. Interestingly, the US 10-year yields actually edged lower, following a flight to safety, but it also suggested bond markets were already more correctly aligned with the Fed’s thinking than stocks.

- We believe US stocks are enjoying a bull market until further notice, but a decent pullback is overdue following their +28% rally in just six months.

Crude oil rallied another +1.5% overnight, which ironically triggered a flight to the safety of bonds, pushing yields down in the process. Brent crude topped $90 as Israeli Prime Minister Benjamin Netanyahu said that would operate against Iran and its proxies. These escalating regional tensions are playing into Donald Trump’s hands ahead of November’s election. The oil complex finally closed on Thursday at its highest levels since October due to heightened geopolitical tensions and potential subsequent supply risks.

- We can see crude oil testing its 2023 highs ~$US97 as geo-political tensions escalate in the Middle East.