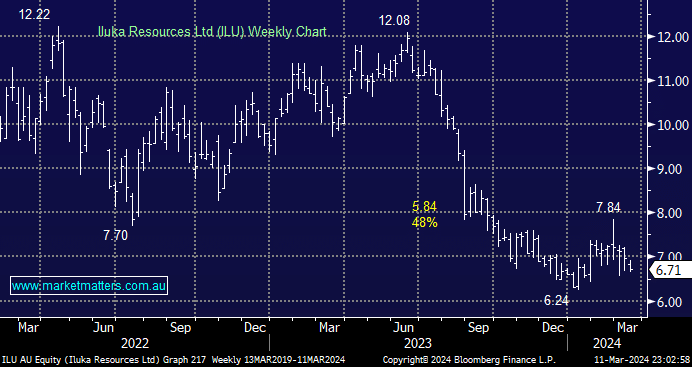

ILU fell another -3.7% on Monday as it continues to struggle after the initial buying following its FY24 result. This was tempered by Macquarie, which downgraded ILU on valuation grounds following its February release. This stock is highly correlated with China’s economic turnaround, which has proven anaemic at best, and in a similar fashion to WDS, we can see it getting a little worse in the short term. Hence we see no reason to move aggressively overweight the Resources Sector, yet.

- We can see ILU testing $6 in the short term, where we may consider averaging our position – MM is long ILU in our Active Growth Portfolio.