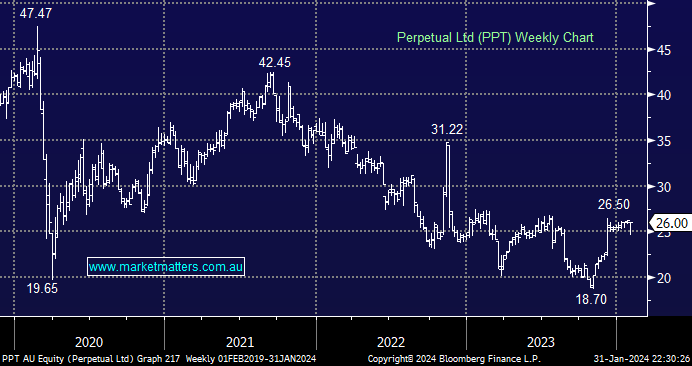

We remain unconvinced about the merits of the Pendal (PDL) acquisition by PPT, and It now looks increasingly like they overpaid, a good outcome for Market Matters at the time as holders of PDL however with critical fund flow weaker than hoped/expected, time has not been kind to the optics around this deal. Importantly, the subsequent financial leverage puts the dividend at risk which is one of the reasons many investors hold PPT.

But all is not lost as corporate activity abounds. In December, PPT rejected a $27 bid from Soul Patts (SOL), one which originally helped push the stock well above its 2023 lows. While the bid was an opportunistic one, we expect PPT shares will price in the likelihood of an improved price plus potential third parties joining the fray, which should support the stock around current levels, offering a defensive characteristic through 2024.

Corporates are circling because of the embedded value in the combined entity, the sum of the parts (Trust Business, Funds Management & Wealth Management) is higher than the current share price implies and could be better realised via a break-up, something that PPT themselves recognise and will address at their upcoming results on the 28th February.

- We see value in PPT and there seems to be an increasing appetite from multiple angles to realise this value, we’re just not sure about the current integration of the PDL acquisition.