The ASX200 is set to test 7000 this morning, although a slight ~10c dip by BHP Group (BHP) in the US will likely slow the index around the psychological level, especially after the index has already surged ~3.4% from last week’s low. We remain optimistic towards the local index into Christmas, and we wouldn’t be surprised to see another test of the 7500-7600 resistance level by the time we welcome 2024.

- The SPI Futures are pointing to a +0.2% open this morning following a strong Friday night on Wall Street capping off its best week for 2023; Real Estate is again likely to be strong as rate concerns wane.

US stocks closed firmly last week, with the influential FANG+ Index now less than 8% below its all-time high, not a bad turnaround considering the weakness through September/ October. Our preference is for further upside after the Fed’s market-friendly rhetoric last week, but after the recent sharp ~7% bounce, the risk/reward is not exciting, with the index back in the middle of its current trading range. We wouldn’t be considering fading strength over the coming weeks, but a rest after this month’s strong +2.9% start wouldn’t surprise us.

- If the FANG+ Index follows the MM roadmap, it will make new all-time highs over the coming months.

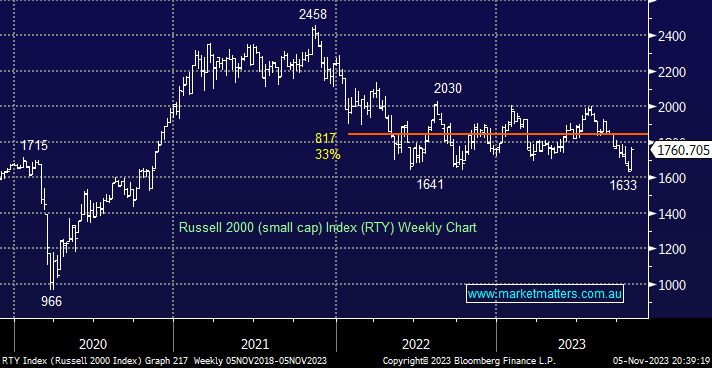

Strength across equities was broad-based last week; we even saw the badly underperforming small-caps enjoy some buying. If markets fully embrace the view that the Fed has reached the end of its hiking cycle, this out-of-favour favour group could snap back with a vengeance over the coming months.

- We can see the Russell 2000 index testing its namesake, the 2000 area, into 2024, another ~13% higher.