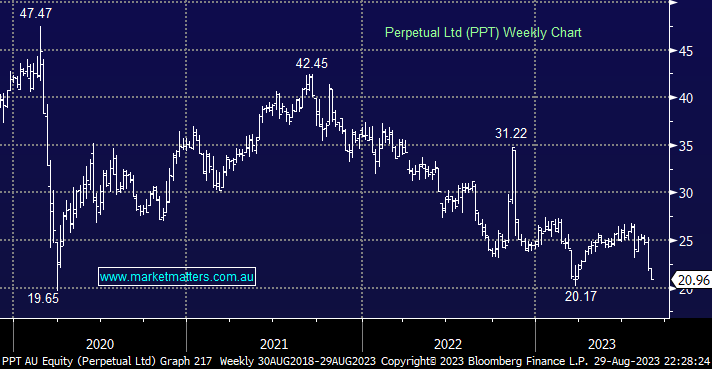

Perpetual was a stock we previously owned in the Income Portfolio, selling out at $25.40 to buy Magellan (MFG) at $8.73 while we’ve also picked up a nice dividend equivalent to 93cps grossed for franking, equating to a 18% return on the MFG position since June. At the time, we wrote that while we still liked PPT, believing it was worth ~$30, we saw better upside in MFG targeting ~$12 (it’s high since the purchase has been $11.04 cum div). Since then, however, Perpetual has struggled and has fallen sharply post results to sit at $20.96. Is this now value, or a value trap?

For now, we think the latter given a few changing dynamics that became obvious in their FY23 results last week. While revenue and profit were largely inline with expectations for the full year, the trends in the 2H deteriorated. The Pendal business which PPT acquired is now going backwards, while PPT itself continues to experience outflows from its funds management division. The reason to own funds management businesses is for operational leverage, as Funds Under Management (FUM) grow, earnings grow at a quicker rate given the bulk of costs are fixed. Buying another funds management business can have the same effect, bringing new FUM in and then cutting the duplicate costs to create synergies. However, it cuts both ways with negative operating leverage an issue when FUM is shrinking, and this is now what we are seeing with PPT (as we saw with Magellan over recent years).

The big difference though for PPT, is they have debt while Magellan was in a net cash position. PPT does have a prized Trust Business which is very valuable and stable, however, that too saw slowing growth in Funds Under Administration (FUA) in the period. The ~$745m in net debt on the Perps balance sheet makes further dividend cuts a probability in our view. PPT have said they want to reduce gearing which sits at (1.87x gross debt / EBITDA) to 1.2x by January 2026, which is a challenge and does not leave much room for error.

- We have switched from a positive bias on PPT (even though we had sold the stock) to a cautious one, happy to be on the sidelines.