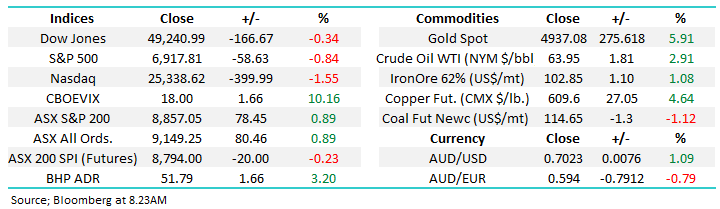

US stocks closed mixed overnight with the S&P500 rallying +0.45% while the tech-based NASDAQ slipped -0.16% following the strong economic data which appears to give the Fed more room to hike rates if and when required. However, in our opinion the only minor pullback in the heavyweight tech names as US short-dated bond yields test their multi-year highs, around 5%, is a clear sign of the underlying strength still being enjoyed by the influential sector.

- No change, in the medium term the path of least resistance, remains on the upside but we can see the NASDAQ consolidating recent gains in the foreseeable future.

Bond yields soared higher overnight following the strong economic data out of the US, the short-dated 2 years are now back within striking distance of the psychological 5% level. Thursday’s prints for Jobless Claims and Gross Domestic Product (GDP) illustrated the US economy is in a far better position than many feared as the Fed continues to hike interest rates. The numbers are an interesting 2-edged sword for stocks telling us the economy is strong but the Fed is likely to keep pushing rates well above 5%.

- We believe both US and European short-dated yields will make fresh highs for 2023.